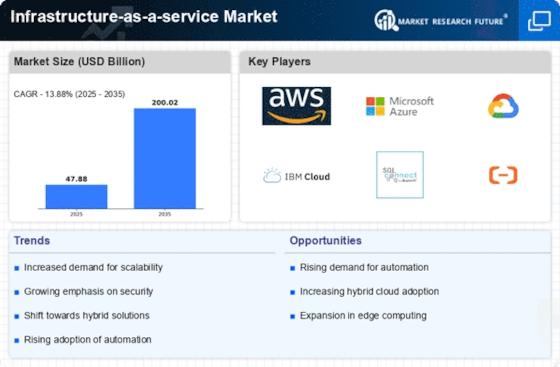

The Infrastructure-as-a-service Market is a rapidly evolving sector characterized by the increasing demand for cloud solutions, flexibility, and scalability. This market encapsulates a variety of companies that provide virtualized computing resources over the internet, enabling organizations to utilize IT infrastructure without the burden of managing physical hardware.

The intense competitive landscape is driven by technological advancements, strategic partnerships, and evolving customer needs, which push companies to innovate continuously. Key players in this arena are leveraging advanced technologies such as artificial intelligence, machine learning, and big data analytics to enhance their service offerings.

Market participants are also focusing on establishing a global footprint to tap into emerging markets while ensuring compliance with regional regulations and standards. As organizations from diverse sectors seek cost-effective and efficient solutions, this market continues to expand, highlighting the competitive insights that shape its future.

Huawei stands as a prominent player in the Infrastructure-as-a-service Market, with a solid reputation for delivering advanced cloud computing solutions and services. The company demonstrates a robust market presence through its comprehensive portfolio, which includes cloud services, DevOps, and distributed computing architecture.

Huawei's strengths lie in its commitment to research and development, enabling it to provide innovative solutions tailored to meet global customer demands. Their focus on enhancing data security and improving the user experience has made them a trusted provider in this competitive landscape.

Furthermore, Huawei's strategic collaborations and partnerships with various technology firms worldwide amplify its influence and market reach, allowing it to remain competitive within the continuously evolving cloud environment.Oracle also plays a significant role in the Infrastructure-as-a-service Market, offering a suite of cloud services that encompass infrastructure, platform, and software-as-a-service solutions.

The company's strengths include its comprehensive database offerings, enterprise resource planning solutions, and the innovative Oracle Cloud Infrastructure, which ensures high performance, security, and scalability. Oracle has made strategic moves through mergers and acquisitions, enhancing its capabilities and expanding its service portfolio to meet the diverse needs of global businesses.

The company maintains a strong focus on providing integrated solutions that cater to various sectors, allowing it to serve multinational clients effectively.Oracle's commitment to continuous improvement and its ability to adapt to changing market conditions ensure that it remains a formidable competitor in the global IaaS landscape, enabling organizations to leverage cloud technologies for enhanced operational efficiency and agility.

Leave a Comment