Network as a Service Market Summary

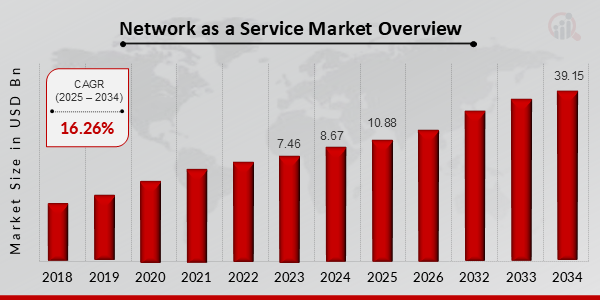

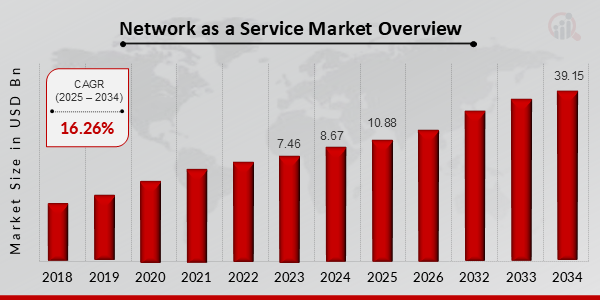

As per Market Research Future Analysis, the Network as a Service (NaaS) Market is projected to grow from USD 10.88 billion in 2025 to USD 39.15 billion by 2034, with a CAGR of 16.26% during the forecast period. The market was valued at USD 8.67 billion in 2024, driven by increasing demand across sectors such as manufacturing, healthcare, and BFSI. The WAN segment dominates the market, accounting for 65% of revenue, while the IT & Telecommunication sector is expected to grow the fastest. North America leads the market, followed by Europe and Asia-Pacific, with significant growth anticipated in the latter due to rising cloud service adoption.

Key Market Trends & Highlights

Key trends driving the NaaS market include increased demand for security and remote work solutions.

- Market size in 2025: USD 10.88 billion; projected to reach USD 39.15 billion by 2034.

- WAN segment accounts for 65% of market revenue.

- IT & Telecommunication sector projected to be the fastest-growing segment during 2023-2030.

- North America holds the largest market share, driven by advanced technology adoption.

Market Size & Forecast

2024 Market Size: USD 8.67 billion

2025 Market Size: USD 10.88 billion

2034 Market Size: USD 39.15 billion

CAGR: 16.26%

Largest Regional Market Share in 2024: North America

Major Players

Major players include VMware Inc, Telstra, Cisco Systems, IBM Corp, and Akamai Technologies.

Figure 1: Network as a Service Market Size, 2025-2034 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Network as a Service Market Trends

Mission-critical business applications require high dependability and security is driving the market growth

Market CAGR for Network as a Service is growing due to security issues. NaaS is a straightforward and efficient network service paradigm enabling companies to manage their network infrastructure easily. Businesses benefit from having dependable and powerful network infrastructure management security. Network providers (NaaS) provide a wide range of network security services, such as secure web gateway, secure DHCP/IPAM/DDI/Domain Name System (DNS)/DDI/DDI, DDoS protection, and zero-trust network access. The epidemic has forced businesses to implement remote work options for their employees and migrate workloads to the cloud.

As a result, the need for network security has skyrocketed in order to protect networks from online attacks. With TLS protocols like IPSec, SSL, and Wireguard, traffic is routed through a tunnel with strong encryption as part of NaaS's comprehensive network infrastructure protection.

Large, small, and medium-sized businesses increasingly demonstrate a significant need in the NaaS market for networking technology to support remote workers. The industry's growing economic market potential is due to the shift towards subscription-based payment methods, on-demand network services, and cheaper capital expenditure. Using the internet, the network as a service (NaaS) is delivered through the cloud-based business model. Wide Area Networking (WAN), Virtual Private Networks (VPN), Bandwidth on Demand (BoD), custom routing, content monitoring and filtering, multicast protocols, security services, and other applications are just a few of the additional and versatile services that NaaS provides.

Some end-user industry companies are also implementing networks as a service to automate their business operations in the healthcare, manufacturing, and retail sectors. For instance, In February 2021, The long-standing strategic partnership between Verizon Business and Cisco System, Inc. has expanded to provide three SD-WAN-managed service choices. Corporate firms benefit from this growth by gaining a worldwide footprint, access to fresh ideas and expertise, and a cutting-edge management and policy administration strategy to enhance organizational results. Thus, driving the Network as a Service market revenue.

Network as a Service Market Segment Insights

Network as a Service Type Insights

Based on type, the Network as a Service market segmentation includes LAN and WAN. The WAN segment dominated the market, accounting for 65% of market revenue. It is a wide area network (WAN) paradigm built on the cloud intended to replace historical WAN, which depends on the hardware. It uses complicated-to-manage communication technologies like multiprotocol label switching (MLPS). As WANaaS is provided over the cloud, physical equipment is replaced. With just a program and a basic internet connection, The Verticals can configure WAN.

Large to mid-size businesses can benefit from WANaaS since it allows quick deployments, improves user productivity and experience, and lowers expenses.

Network as a Service Insights

Based on Service, the Network as a Service market segmentation includes WAN Connection, Data Centers, and BOD. The WAN Connection category generated the most income. Due to the acceptance of deployment and integration types across industrial verticals, the information middle networking solution will perform well at some point.

Network as a Service Component Insights

Based on components, the Network as a Service market segmentation includes infrastructure and technology services. The infrastructure segment held the majority share in 2022, contributing around ~67% concerning the Network as a Service market revenue. Network service providers and cloud providers offer networking services for networking and network security resources like VPN, WAN, and firewall. Customers may manage and use their Network without having to maintain network infrastructure, and it optimizes resource allocation and computing resources as a single, integrated module.

Network as a Service End User Insights

End User have bifurcated the Network as a Service market data into IT & Telecommunication, BFSI, and Healthcare. The IT & Telecommunication segment dominated the market in 2022 and is projected to be the faster-growing segment during the forecast period, 2023-2030. Increased use cases, cloud services, and IT infrastructure are all credited with the rise. In IT and telecommunications, network infrastructure is crucial because it reduces the digital divide by providing rapid network services and finding cost-effective solutions to bandwidth shortage issues. The shared active and passive infrastructure makes high-speed internet access possible, enabling networks to grow commercially.

The 5G network's key building blocks are network-as-a-service solutions, and the NaaS platform is expected to be widely adopted by the telecommunications industry..

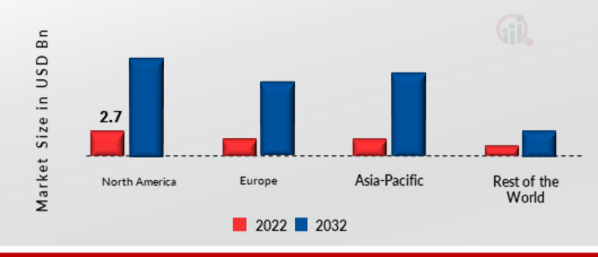

Figure 1: Network as a Service Market, by End User, 2022 & 2032 (USD billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Network as a Service Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Network as a Service market area will dominate this market; The United States is a developed country with a strong propensity for adopting and implementing cutting-edge technology, developing network automation, and increasing the use of cloud-based services, all of which have a positive impact on the Network as a Service (NaaS) industry.

As providers release hybrid products that incorporate software, cloud intelligence, and the flexibility to control on-premises hardware, most IT teams will probably embrace NaaS more frequently over the next five or so years. The need for improved network services is rising due to the significant expansion of connected and mobile devices. The area had the greatest uptake of linked devices since the United States consistently led the world in adopting new technologies.

Further, the major countries studied in the market report are The U.S., France, the UK, Italy, China, Japan, India, Spain, Canada, Australia, German, South Korea, and Brazil.

Figure 2: NETWORK AS A SERVICE MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe Network as a Service market accounts for the second-largest market share because of adoption procedures, growing awareness, and worries about network service. Further, The greatest market share for Germany Network as a Service, and the UK Network as a Service market was the fastest-growing market in the European region.

From 2023 to 2032, the fastest CAGR is anticipated in the Asia-Pacific Network as a Service Market. The rise is due to the region's start-ups' use of cloud services, including SaaS, PaaS, and NaaS, as well as the rising penetration of cloud computing services. A large and diverse client base in India and China fuels demand and produces new NaaS prospects. Moreover, China's Network as a Service market held the largest market share, and the Indian Network as a Service market was the fastest-growing market in the Asia-Pacific region.

Network as a Service Key Market Players & Competitive Insights

Prominent industry participants are spending a lot of money on R&D to broaden their product offerings, which will spur further expansion of the Network as a Service market. Important market developments include new product releases, contractual agreements, mergers and acquisitions, greater investments, and collaboration with other organizations. Market participants also engage in several strategic actions to broaden their worldwide reach. For the Network as a service industry to expand and prosper in a market that is becoming more difficult and competitive, it must offer reasonably priced goods.

One of the key business strategies manufacturers use in the worldwide Network as a Service industry to assist customers and expand the market sector is local manufacturing to reduce operating costs. Some of the biggest medical benefits in recent years have come from the Network as a service industry. Major players in the Network as a Service market, including VMware Inc, Telstra, and others, are attempting to increase market demand by investing in research and development operations.

With headquarters in Palo Alto, California, VMware, Inc. is an cloud computing and virtualization technology business. The x86 architecture was virtualized for the first time by a commercially successful firm, VMware. VMware's desktop software supports Microsoft Windows, Linux, and macOS. In August 2022, According to a press release from VMware Inc., the business has made advancements in its growing networking and security systems that will make it easier for clients to adopt the cloud operating model.

An Australian corporation called Telstra Group Ltd develops and manages telecommunications networks and distributes voice, mobile, internet access, pay television, and other goods and services. In May 2022, Telstra partnered with Prysmian Group to create the first cutting-edge inter-capital fiber network. As part of the multi-year national fiber network project, Telstra will construct a new, "state-of-the-art," intercity dual fiber channel that may add up to 20,000 route kilometers of additional fiber-optic terrestrial cable, increasing capacity for regional areas as well as inter-capital travel.

Key Companies in the Network as a Service market include

Network as a Service Industry Developments

-

Q2 2024: Cisco Launches New Network-as-a-Service Platform for Enterprises Cisco announced the launch of its new NaaS platform, designed to help enterprises manage and scale their network infrastructure with subscription-based services.

-

Q2 2024: Aryaka Raises $100 Million to Expand Network-as-a-Service Offerings Aryaka, a leading NaaS provider, secured $100 million in funding to accelerate product development and global expansion of its managed SD-WAN and SASE services.

-

Q3 2024: Verizon and HPE Announce Strategic Partnership for Network-as-a-Service Solutions Verizon and Hewlett Packard Enterprise (HPE) entered a partnership to deliver joint NaaS solutions targeting large enterprises and government clients.

-

Q3 2024: Juniper Networks Appoints New CEO to Drive Network-as-a-Service Strategy Juniper Networks named a new CEO, emphasizing a renewed focus on expanding its NaaS portfolio and cloud-based networking solutions.

-

Q4 2024: AT&T Wins $250 Million Federal Contract for Network-as-a-Service Deployment AT&T secured a $250 million contract from a U.S. federal agency to deploy NaaS solutions across multiple government sites.

-

Q4 2024: Nokia Launches NaaS Platform for 5G Private Networks Nokia introduced a new NaaS platform tailored for 5G private networks, enabling enterprises to deploy and manage secure, scalable connectivity.

-

Q1 2025: VMware Spins Off NaaS Business Unit to Focus on Cloud Networking VMware announced the spin-off of its NaaS business unit, aiming to accelerate innovation in cloud-based networking and edge services.

-

Q1 2025: Oracle Unveils Network-as-a-Service for Multi-Cloud Environments Oracle launched a new NaaS offering designed to simplify network management across multi-cloud deployments for enterprise customers.

-

Q2 2025: Telstra Acquires CloudGenix to Expand Network-as-a-Service Portfolio Telstra completed the acquisition of CloudGenix, enhancing its NaaS capabilities with advanced SD-WAN and cloud networking solutions.

-

Q2 2025: IBM Partners with Equinix to Deliver Global Network-as-a-Service Solutions IBM and Equinix announced a partnership to offer global NaaS solutions, leveraging Equinix's data center footprint and IBM's cloud networking expertise.

-

Q3 2025: Ciena Launches AI-Driven Network-as-a-Service Platform Ciena introduced an AI-powered NaaS platform, enabling automated network optimization and predictive analytics for enterprise clients.

-

Q3 2025: GTT Communications Wins Major European NaaS Contract GTT Communications secured a multi-year contract to provide NaaS solutions for a consortium of European financial institutions.

Network as a Service Market Segmentation

Network as a Service Type Outlook

Network as Service Outlook

-

WAN Connection

-

Data Center

-

BOD

Network as a Service Component Outlook

-

Infrastructure

-

Technology Service

Network as a Service End-User Outlook

-

IT & Telecommunication

-

BFSI

-

Healthcare

Network as a Service Regional Outlook

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Rest of Europe

-

Asia-Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Australia

-

Rest of Asia-Pacific

-

Rest of the World

-

Middle East

-

Africa

-

Latin America

| Attribute/Metric |

Details |

| Market Size 2024 |

8.67 (USD Billion) |

| Market Size 2025 |

10.88 (USD Billion) |

| Market Size 2034 |

39.15 (USD Billion) |

| Compound Annual Growth Rate (CAGR) |

16.26% (2025 - 2034) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2034 |

| Historical Data |

2019 - 2023 |

| Market Forecast Units |

USD Billion |

| Segments Covered |

Type, Service, Component, End User and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Alcatel Lucent (U.S.), Brocade Communications Systems Inc. (U.S.), Ciena Corporation (U.S), Cisco Systems (U.S.), IBM Corp. (U.S.), Juniper Networks (U.S.), NEC Corp. (Japan), VMware (U.S.), Aryaka Networks Inc. (U.S.), AT&T (U.S.) |

| Key Market Opportunities |

Rising use of Networking Technologies by SMEs & Large-Scale Organizations |

| Key Market Dynamics |

Increase in use of cloud technology |

Network as a Service Market Highlights:

Frequently Asked Questions (FAQ):

The Network as a Service market size was valued at USD 8.67 Billion in 2024.

The market is projected to grow at a CAGR of 16.26% during the forecast period, 2025-2034.

North America had the largest share in the market

The key players in the market are Alcatel Lucent (U.S.), Brocade Communications Systems Inc. (U.S.), Ciena Corporation (U.S), Cisco Systems (U.S.), IBM Corp. (U.S.).

The WAN category dominated the market in 2022.

The IT & Telecommunication had the largest share in the market.