Market Analysis

In-depth Analysis of Insurance Protection Product Market Industry Landscape

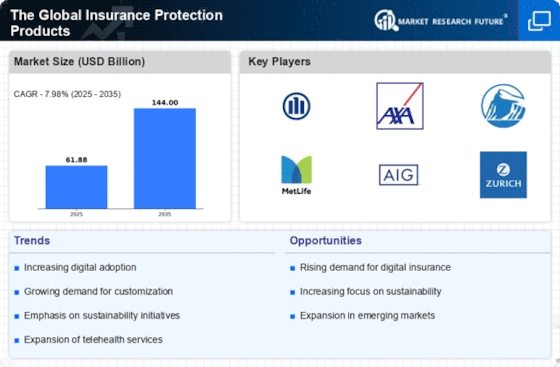

The Insurance Protection Product market is shaped by dynamic factors influenced by changing consumer needs, regulatory developments, technological advancements, and the evolving landscape of risk management. Understanding these market dynamics is crucial for insurance providers, brokers, and consumers seeking effective protection solutions. Consumer awareness and the need for insurance protection products greatly affect market dynamics. With increasing knowledge among the individuals about possible risks and uncertainties, insurance products that provide wide coverage along with financial security are witnessing an upsurge in demand. The dynamics encompass the evolving process of digital transformation within insurance. Innovations in insurtech, such as digital platforms, artificial intelligence and data analytics are upsetting traditional insurance models that is changing customer experiences, process efficiency levels and product innovativeness. The shifts in the market dynamics indicate towards personalized and customised insurance solutions. By using data analytics and customer insights, insurance providers are able to customize protection products based on individual needs which is flexible as well as relevant in the diversifying market. The dynamics evolve from regulatory changes and compliance requirements. Regulatory standards in the insurance protection products have to change from time to time, with guaranteed transparency and fairness observing those that protect policyholders interests. The market dynamics include increased demand of cybersecurity coverage and data protection. As cyber crimes are becoming more frequent, insurance protection products no longer solely focus on traditional hazards but also get into the details of information and digital properties safety. The market dynamics that have been considered are those which include the link between health and wellness programs to insurance protection offers. Insurance carriers are working with health-oriented platforms and adopting wearable technology to encourage policyholders in embracing healthy living styles thus reducing risks overall risk, hence promoting long term well being. Global economic trends and market resilience affect the dynamics of markets. Insurance protection products should also adjust to changes in the economy, geopolitical uncertainties and new challenges offering stability and financial safety for policyholders amid a highly dynamic global environment. The dynamics are characterized by a rising focus on ESG aspects. The protection products from insurance are becoming socially responsive to societal ideals as they adopt ESG principles; these provisions include sustainability, ethical practices and social responsibility. The dynamics include financial inclusion programs. Insurance providers are coming up with ways of making the protection products more affordable to previously underserved population, which is an overall effort towards financial inclusion and coverage gaps. The dynamics encompass customer education and engagement. Insurance companies commit to educational programs that enable consumers better understanding of insurance protection products and thus empower them in making the right risk management choices.

Market dynamics are influenced by the lessons learned from the COVID-19 pandemic. Insurance protection products are adapting to address the unique risks associated with pandemics and public health emergencies, emphasizing the importance of preparedness and financial protection during unprecedented events.

Leave a Comment