Market Trends

Key Emerging Trends in the Insurance Protection Product Market

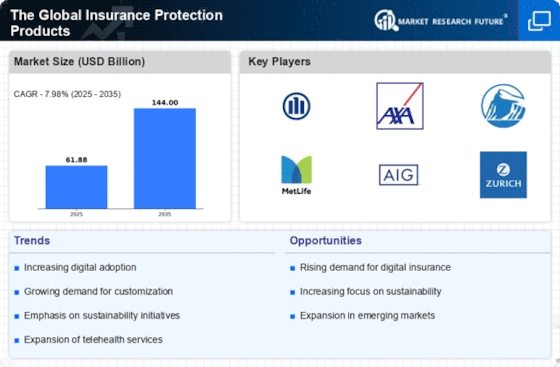

The Insurance Protection Product market is experiencing a notable trend with an increasing emphasis on financial protection. Consumers are recognizing the importance of safeguarding their financial well-being against unforeseen events, such as illness, accidents, or death. This trend is driving the demand for a variety of insurance protection products that offer comprehensive coverage and financial security. Demand for health and critical illness coverage grows rapidly within the Insurance Protection Product market. Health issues and medical bills continue to rise, individuals are looking for insurance products that cover hospitalizations costs including treatments such as critical illnesses. This trend is a proactive response to controlling healthcare-related financial risks. Innovations in product design and features are being observed by the market as insurance providers try to distinct their products. Customized policies, flexible coverage options and innovative riders are becoming common. This trendies to the heterogeneous consumer needs and preferences, encouraging competition in product development within the insurance industry. One of the key trends in Insurance Protection Product market is adoption of technology. Insurance providers have embedded digital platforms, mobile apps and online portals to ensure the provision of smooth services. These facilitate streamlined policy issuance, easy claims processing and real time access to the policies. Technological adoption improves customer satisfaction and operational efficiencies. Lifestyle and Income Protection have thus become key foci of the market in Insurance Product for protection. Loss of income due to disability, critical illness or other unseen events that are currently covered by the products under consideration gaining popularity. Such a tendency with the instinct of protection reflects one’s lifestyle and opportunity to have financial stability. Traditional insurers and Insurtech Start ups partnership are defining the trends in Insurance Protection Product market. The insurtech firms offer technological innovation, data analytics and digital distribution whereas established companies provide experience in the field as well as compliance with regulations. This budding tendency speeds up digitalization and modernity of insurance services.

There is a growing demand for long-term care insurance within the market. As populations age, individuals are recognizing the need for coverage that addresses the costs associated with long-term care, including nursing home expenses and home healthcare. This trend reflects a proactive approach to financial planning for later stages of life.

Leave a Comment