Growth in Consumer Electronics

The Integrated Microwave Assembly Market is also benefiting from the growth in consumer electronics. With the proliferation of smart devices, including smartphones, tablets, and wearables, the demand for compact and efficient microwave assemblies is on the rise. The consumer electronics market is projected to reach over 1 trillion USD by 2025, which suggests a substantial opportunity for microwave assembly manufacturers. These components are integral to the functionality of various devices, enabling features such as wireless connectivity and high-frequency signal processing. As manufacturers strive to meet consumer expectations for performance and miniaturization, the Integrated Microwave Assembly Market is likely to see continued expansion, driven by innovations in consumer technology.

Rising Demand for Telecommunications

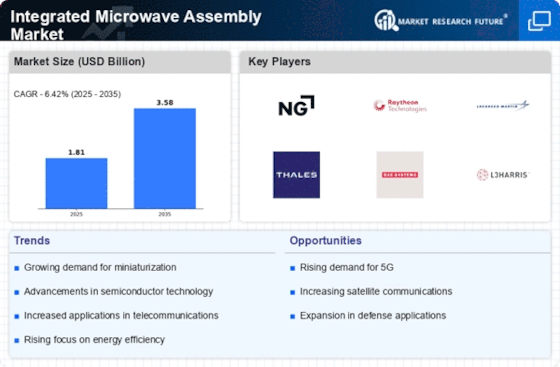

The Integrated Microwave Assembly Market is experiencing a notable surge in demand driven by the telecommunications sector. As the need for high-speed data transmission escalates, microwave assemblies are increasingly utilized in 5G infrastructure. The market for 5G technology is projected to reach approximately 700 billion USD by 2026, indicating a robust growth trajectory. This demand is further fueled by the expansion of mobile networks and the increasing reliance on wireless communication. Consequently, manufacturers are focusing on developing advanced microwave assemblies that can support higher frequencies and bandwidths, thereby enhancing overall network performance. The integration of microwave technology into telecommunications is likely to continue, positioning the Integrated Microwave Assembly Market as a critical component in the evolution of communication technologies.

Advancements in Aerospace and Defense

The Integrated Microwave Assembly Market is significantly influenced by advancements in the aerospace and defense sectors. The increasing complexity of military and aerospace applications necessitates the use of sophisticated microwave assemblies for radar, satellite communications, and electronic warfare systems. The global defense spending is anticipated to exceed 2 trillion USD by 2026, which could lead to heightened investments in advanced microwave technologies. These assemblies are essential for ensuring reliable communication and navigation systems in challenging environments. As defense contractors seek to enhance the capabilities of their systems, the demand for high-performance microwave assemblies is expected to rise, thereby propelling the growth of the Integrated Microwave Assembly Market.

Emergence of Internet of Things (IoT)

The Integrated Microwave Assembly Market is poised for growth due to the emergence of the Internet of Things (IoT). As more devices become interconnected, the need for efficient microwave assemblies that facilitate communication between these devices is becoming increasingly critical. The IoT market is expected to surpass 1.5 trillion USD by 2025, indicating a vast potential for microwave technology integration. These assemblies play a vital role in enabling seamless data transmission and connectivity across various applications, from smart homes to industrial automation. As the demand for IoT solutions continues to rise, the Integrated Microwave Assembly Market is likely to experience significant growth, driven by the need for reliable and high-performance microwave components.

Regulatory Support for Advanced Technologies

The Integrated Microwave Assembly Market is benefiting from regulatory support aimed at promoting advanced technologies. Governments are increasingly recognizing the importance of microwave technology in enhancing communication, defense, and transportation systems. Initiatives to support research and development in microwave applications are being implemented, which could lead to increased funding and resources for innovation. This regulatory environment is conducive to the growth of the Integrated Microwave Assembly Market, as it encourages manufacturers to invest in new technologies and improve existing products. As regulations evolve to support technological advancements, the market is likely to see a boost in demand for integrated microwave assemblies across various sectors.