Advancements in Data Analytics

The Intelligent Completion Market is significantly influenced by advancements in data analytics. The ability to analyze vast amounts of data in real-time allows companies to make informed decisions and optimize their operations. With the rise of big data and machine learning, organizations are leveraging these technologies to enhance their intelligent completion strategies. For instance, predictive analytics can help in forecasting equipment failures, thereby reducing downtime and maintenance costs. The market for data analytics is expected to reach USD 274 billion by 2022, indicating a robust growth trajectory. This trend suggests that the Intelligent Completion Market will increasingly integrate sophisticated data analytics tools, leading to improved performance and decision-making capabilities.

Increased Demand for Automation

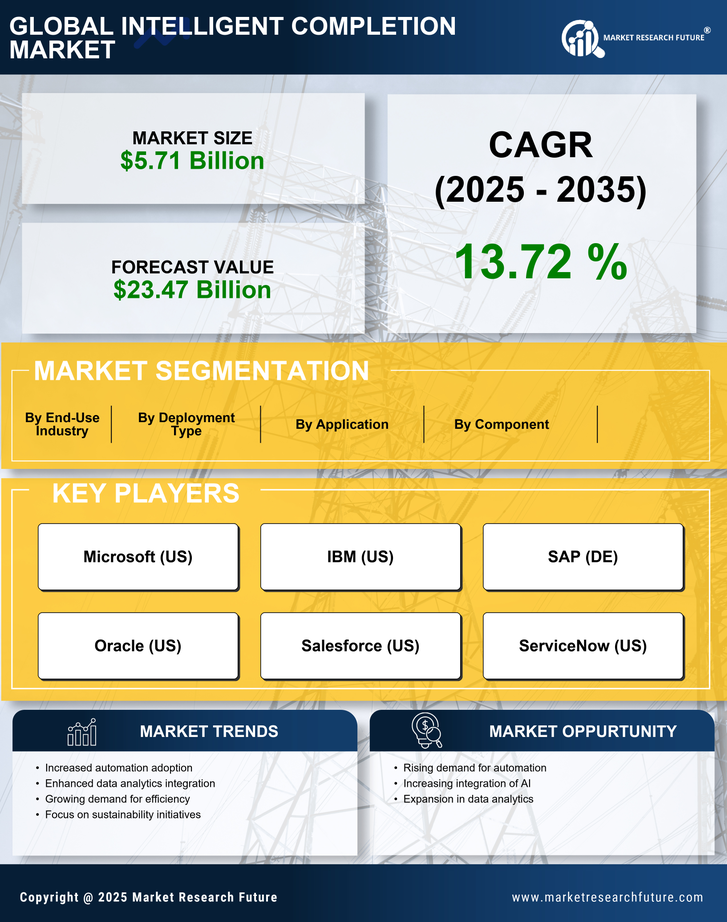

The Intelligent Completion Market is experiencing a surge in demand for automation solutions across various sectors. Companies are increasingly adopting intelligent completion technologies to enhance operational efficiency and reduce human error. This trend is particularly evident in industries such as oil and gas, where automation can lead to significant cost savings. According to recent data, the automation market is projected to grow at a compound annual growth rate of 9.5% over the next five years. This growth is likely to drive investments in intelligent completion technologies, as organizations seek to streamline processes and improve productivity. As a result, the Intelligent Completion Market is poised to benefit from this increasing focus on automation, leading to enhanced competitiveness and innovation.

Integration of IoT Technologies

The Intelligent Completion Market is increasingly influenced by the integration of Internet of Things (IoT) technologies. The proliferation of connected devices enables real-time monitoring and data collection, which can significantly enhance intelligent completion processes. By utilizing IoT solutions, companies can gain valuable insights into their operations, leading to improved decision-making and efficiency. The IoT market is expected to grow exponentially, with estimates suggesting it could reach USD 1.1 trillion by 2026. This growth indicates a strong potential for the Intelligent Completion Market to leverage IoT technologies, thereby enhancing operational capabilities and driving innovation in completion strategies.

Growing Environmental Regulations

The Intelligent Completion Market is being shaped by the growing environmental regulations that are being implemented across various sectors. As governments and regulatory bodies impose stricter environmental standards, companies are compelled to adopt intelligent completion technologies that minimize environmental impact. This trend is particularly pronounced in industries such as oil and gas, where compliance with environmental regulations is critical. The market for environmental compliance solutions is projected to grow significantly, indicating a shift towards sustainable practices. Consequently, the Intelligent Completion Market is likely to see increased demand for technologies that not only enhance operational efficiency but also align with environmental regulations, thereby promoting sustainability.

Rising Focus on Operational Efficiency

The Intelligent Completion Market is witnessing a rising focus on operational efficiency as organizations strive to maximize productivity and minimize costs. Companies are increasingly recognizing the importance of intelligent completion technologies in achieving these goals. By implementing advanced completion techniques, businesses can optimize resource allocation and enhance project execution. Recent studies indicate that organizations that adopt intelligent completion solutions can achieve up to a 30% reduction in operational costs. This emphasis on efficiency is likely to drive further investments in the Intelligent Completion Market, as companies seek to remain competitive in an ever-evolving landscape. As a result, the market is expected to expand, fueled by the demand for innovative solutions that enhance operational performance.