Regulatory Support and Incentives

Regulatory frameworks play a crucial role in shaping the Inter-Array Offshore Wind Cable Market. Governments are increasingly implementing supportive policies and incentives aimed at promoting renewable energy projects. For example, many countries have established feed-in tariffs and tax credits for offshore wind projects, which indirectly bolster the demand for inter-array cables. As of 2025, it is estimated that regulatory support could account for up to 30% of the market growth in this sector. This supportive environment encourages investments in infrastructure, thereby enhancing the overall viability of the Inter-Array Offshore Wind Cable Market.

Increased Focus on Energy Security

The growing emphasis on energy security is influencing the Inter-Array Offshore Wind Cable Market. As countries seek to diversify their energy sources and reduce dependence on fossil fuels, offshore wind energy is becoming a strategic priority. This shift is likely to result in increased investments in inter-array cable systems, which are essential for the efficient operation of offshore wind farms. By 2025, it is anticipated that energy security concerns could drive a 15% increase in demand for inter-array cables, further solidifying their role in the Inter-Array Offshore Wind Cable Market.

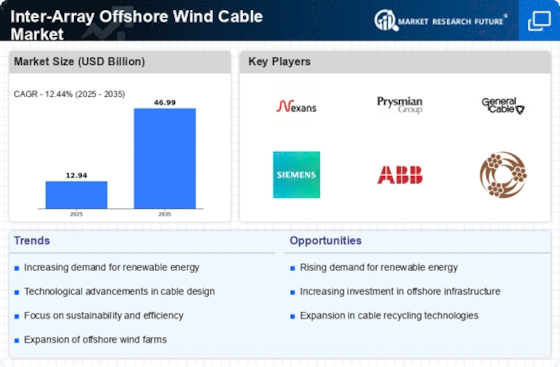

Growing Demand for Renewable Energy

The global shift towards renewable energy sources is significantly impacting the Inter-Array Offshore Wind Cable Market. As nations strive to meet their carbon reduction targets, the demand for offshore wind energy is escalating. Recent projections indicate that offshore wind capacity could reach over 200 GW by 2030, necessitating a substantial increase in inter-array cable installations. This growing demand is likely to drive market expansion, as developers seek reliable and efficient cable solutions to connect wind turbines to substations. Consequently, the Inter-Array Offshore Wind Cable Market is poised for robust growth in response to this increasing appetite for clean energy.

Investment in Offshore Wind Projects

Investment in offshore wind projects is a key driver for the Inter-Array Offshore Wind Cable Market. With the rising awareness of climate change and the need for sustainable energy solutions, private and public sectors are channeling significant funds into offshore wind initiatives. Reports suggest that investments in offshore wind could exceed $100 billion by 2030, creating a substantial demand for inter-array cables. This influx of capital not only facilitates the construction of new wind farms but also enhances the overall infrastructure, thereby benefiting the Inter-Array Offshore Wind Cable Market.

Technological Advancements in Cable Design

The Inter-Array Offshore Wind Cable Market is experiencing a surge in technological advancements that enhance cable design and performance. Innovations such as improved insulation materials and advanced manufacturing techniques are leading to cables that are more durable and efficient. For instance, the introduction of high-voltage direct current (HVDC) technology is enabling longer transmission distances with reduced energy losses. This is particularly relevant as the industry anticipates a compound annual growth rate (CAGR) of approximately 10% over the next five years. Such advancements not only improve the reliability of energy transmission but also reduce maintenance costs, thereby attracting more investments into the Inter-Array Offshore Wind Cable Market.