Market Analysis

In-depth Analysis of Interactive Display Market Industry Landscape

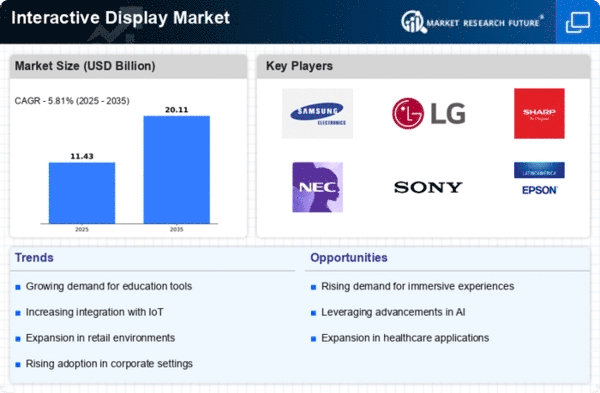

The interactive display industry is expanding and changing quickly thanks to new technologies and a growing need for immersive and collaborative solutions in many fields. It's clear that the market gains from the growing use of digital displays in business, healthcare, education, and stores. Interactive displays have become very popular in the education field because they make learning more fun and interesting. Interactive displays help people work together in meetings and talks, so businesses are getting more of them. By letting people communicate with material in real time, these displays make conversation more interesting and lively. They also spark new ideas and innovations. Businesses are changing how they talk to each other and show information because of the move toward engaging tools. The healthcare industry has also accepted and started to use interactive displays for teaching doctors, making diagnoses, and teaching patients. Interactively visualizing difficult medical information helps both doctors and people understand it better. The main reason healthcare facilities use interactive displays is that they get patients more involved and improve their health.

The store business is changing because of engaging displays that make shopping more fun. With these displays, stores can make personalized and engaging marketing efforts that get people interested in their products and give them useful information about them. Interactive ones are very useful because they change the way people act and bring in more sales.

The rate of growth of the world market depends on how quickly technology improves. Among other things, technologies like virtual reality (VR) and augmented reality (AR) have made dynamic displays even more useful. This has made it possible to make experiences that are more complicated and engaging, which has led to more demand in many areas. In order to stay ahead of the competition, big names in the interactive display market are always coming up with new ideas. They put a lot of effort into research and development to meet the needs of many different businesses, add new features, and make things run better. People who use technology and people who sell it are working together to make unique solutions. This is leading to new ideas and market growth. Growing technologies are coming together with digital displays, which means the market is ready to grow even more. When the IoT and AI work together, they should open up new options that will make dynamic displays even more important to our daily lives. Businesses and institutions are becoming more aware of how useful interactive displays are for improving communication, teamwork, and participation. This will cause the market to change even more, opening up new possibilities and encouraging more innovation in the interactive display area.

Leave a Comment