Market Growth Projections

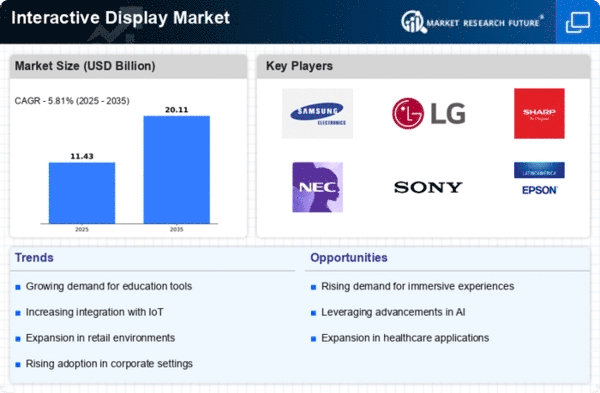

The Global Interactive Display Market Industry is poised for substantial growth, with projections indicating a market value of 17.5 USD Billion in 2024 and an anticipated increase to 35 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 6.49% from 2025 to 2035, reflecting the increasing adoption of interactive display technologies across various sectors. Factors contributing to this growth include advancements in display technologies, rising demand for interactive solutions in education and retail, and the expanding applications in corporate and healthcare environments. These projections highlight the potential for innovation and investment within the Global Interactive Display Market Industry.

Growth in Retail Sector Engagement

The Global Interactive Display Market Industry is significantly influenced by the retail sector's growing emphasis on customer engagement. Retailers are increasingly utilizing interactive displays to create immersive shopping experiences that captivate consumers. For example, interactive kiosks and digital signage provide personalized product information and promotions, enhancing customer interaction and satisfaction. This trend is underscored by the anticipated market growth to 35 USD Billion by 2035, suggesting a strong correlation between interactive display adoption and retail performance. As retailers seek to differentiate themselves in a competitive landscape, the demand for innovative interactive display solutions is expected to rise, further propelling the Global Interactive Display Market Industry.

Emerging Applications in Healthcare

The Global Interactive Display Market Industry is experiencing growth due to emerging applications in the healthcare sector. Interactive displays are increasingly utilized for patient engagement, medical training, and telemedicine solutions. For instance, hospitals are adopting interactive kiosks to provide patients with information and streamline check-in processes. Additionally, interactive displays are used in medical training programs to simulate real-life scenarios, enhancing learning outcomes for healthcare professionals. This trend indicates a diversification of the market, as healthcare organizations recognize the benefits of interactive display technologies. The integration of these solutions is likely to contribute to the overall expansion of the Global Interactive Display Market Industry.

Increased Adoption in Corporate Environments

The Global Interactive Display Market Industry is witnessing increased adoption of interactive displays in corporate environments, where they serve as essential tools for collaboration and communication. Businesses utilize interactive displays for presentations, meetings, and training sessions, enhancing productivity and engagement among employees. For example, companies are integrating interactive whiteboards and video conferencing solutions to facilitate remote collaboration. This trend aligns with the overall market growth, as organizations recognize the value of interactive displays in improving operational efficiency. As the corporate sector continues to embrace these technologies, the Global Interactive Display Market Industry is expected to expand, reflecting the evolving needs of modern workplaces.

Rising Demand for Interactive Learning Solutions

The Global Interactive Display Market Industry experiences a notable surge in demand for interactive learning solutions, particularly in educational institutions. As schools and universities increasingly adopt technology-driven teaching methods, interactive displays facilitate engaging and immersive learning experiences. For instance, the integration of interactive whiteboards and touchscreens in classrooms enhances student participation and collaboration. This trend is reflected in the projected market value of 17.5 USD Billion in 2024, indicating a robust growth trajectory. The emphasis on interactive learning tools is likely to drive further investments in the Global Interactive Display Market Industry, fostering innovation and development in educational technologies.

Technological Advancements in Display Technologies

Technological advancements play a pivotal role in shaping the Global Interactive Display Market Industry. Innovations such as high-resolution displays, touch-sensitive interfaces, and augmented reality capabilities enhance the functionality and appeal of interactive displays. For instance, the introduction of OLED technology has improved image quality and energy efficiency, making interactive displays more attractive to consumers and businesses alike. As these technologies evolve, they are likely to drive market growth, with a projected compound annual growth rate of 6.49% from 2025 to 2035. This continuous evolution in display technologies is expected to create new opportunities within the Global Interactive Display Market Industry, fostering a competitive environment.

Leave a Comment