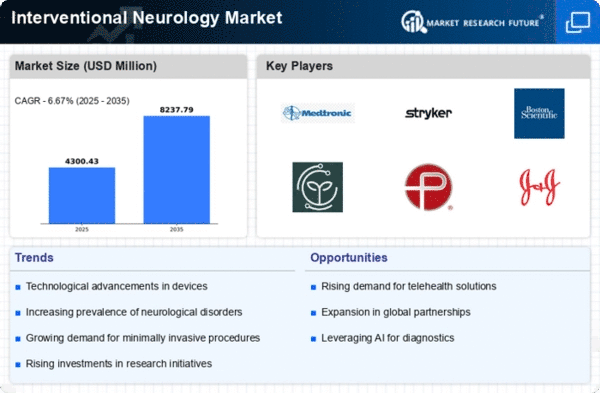

Market Growth Projections

The Global Interventional Neurology Market Industry is projected to witness substantial growth in the coming years. The market is expected to reach a valuation of 2.98 USD Billion by 2035, reflecting a robust compound annual growth rate (CAGR) of 10.87% from 2025 to 2035. This growth trajectory is indicative of the increasing demand for advanced interventional techniques and the rising prevalence of neurological disorders. As healthcare systems worldwide adapt to these challenges, the market is poised for expansion, driven by technological advancements, increased awareness, and supportive regulatory environments.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are instrumental in shaping the Global Interventional Neurology Market Industry. Governments and health authorities are increasingly recognizing the importance of interventional neurology in improving patient outcomes, leading to the establishment of supportive regulatory frameworks. Additionally, favorable reimbursement policies for interventional procedures encourage healthcare providers to adopt these techniques, ensuring that patients have access to necessary treatments. This supportive environment not only enhances the market's attractiveness but also fosters innovation as companies are incentivized to develop new technologies and procedures. As these policies evolve, they are likely to further stimulate market growth.

Rising Investment in Healthcare Infrastructure

The Global Interventional Neurology Market Industry is bolstered by rising investments in healthcare infrastructure across various regions. Governments and private entities are increasingly allocating funds to enhance healthcare facilities, particularly in developing countries. This investment facilitates the acquisition of advanced medical equipment and training for healthcare professionals, thereby improving the quality of care for neurological disorders. Enhanced infrastructure not only supports the implementation of interventional neurology techniques but also increases patient access to these services. As healthcare systems evolve, the market is likely to benefit from this trend, fostering an environment conducive to growth and innovation.

Increasing Prevalence of Neurological Disorders

The Global Interventional Neurology Market Industry is experiencing growth due to the rising prevalence of neurological disorders such as stroke, epilepsy, and multiple sclerosis. According to the World Health Organization, neurological disorders affect millions globally, with stroke being a leading cause of disability. This increasing incidence necessitates advanced interventional techniques, driving demand for innovative treatment options. As the global population ages, the burden of these disorders is expected to rise, further propelling the market. In 2024, the market is valued at 0.96 USD Billion, indicating a robust foundation for future growth as healthcare systems adapt to meet these challenges.

Growing Awareness and Education on Neurological Health

Growing awareness and education regarding neurological health are pivotal in driving the Global Interventional Neurology Market Industry. Public health campaigns and educational initiatives are increasingly informing individuals about the symptoms and risks associated with neurological disorders. This heightened awareness encourages early diagnosis and treatment, leading to a greater demand for interventional procedures. Furthermore, healthcare professionals are receiving enhanced training on the latest interventional techniques, which improves patient care. As awareness continues to rise, it is anticipated that the market will experience sustained growth, aligning with the projected CAGR of 10.87% from 2025 to 2035.

Technological Advancements in Interventional Techniques

Technological advancements are a key driver in the Global Interventional Neurology Market Industry. Innovations such as minimally invasive procedures, advanced imaging techniques, and robotic-assisted surgeries enhance the efficacy and safety of neurological interventions. For instance, the development of neurovascular stents and embolization devices has revolutionized the treatment of conditions like aneurysms and arteriovenous malformations. These advancements not only improve patient outcomes but also reduce recovery times, making interventional procedures more appealing to both patients and healthcare providers. As these technologies continue to evolve, they are expected to contribute significantly to the market's expansion, particularly as it approaches a projected value of 2.98 USD Billion by 2035.

Leave a Comment