Rising Incidence of Neurological Disorders

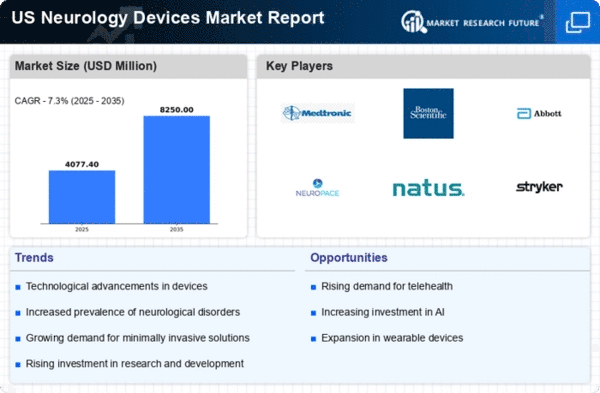

The increasing prevalence of neurological disorders in the US is a primary driver for the neurology devices market. Conditions such as Alzheimer's disease, Parkinson's disease, and epilepsy are becoming more common, affecting millions of individuals. According to the CDC, approximately 1 in 6 adults in the US experience some form of neurological condition. This growing patient population necessitates advanced diagnostic and therapeutic devices, thereby propelling market growth. The neurology devices market is expected to witness substantial expansion as healthcare providers seek innovative solutions for effective management of these disorders. Furthermore, the aging population, which is more susceptible to neurological diseases, adds to the demand for specialized devices. As a result, the neurology devices market is likely to experience a compound annual growth rate (CAGR) of around 8% over the next few years.

Technological Innovations in Device Development

Technological advancements play a crucial role in shaping the neurology devices market. Innovations such as neurostimulation devices, advanced imaging technologies, and wearable monitoring systems are revolutionizing patient care. For instance, the integration of artificial intelligence (AI) in diagnostic tools enhances accuracy and efficiency, leading to better patient outcomes. The market for neurostimulation devices alone is projected to reach $8 billion by 2026, reflecting a growing trend towards minimally invasive procedures. Additionally, the development of portable and user-friendly devices is making neurological assessments more accessible to patients and healthcare providers alike. These innovations not only improve the quality of care but also drive competition among manufacturers, further stimulating growth in the neurology devices market.

Increased Investment in Research and Development

Investment in research and development (R&D) is a significant driver of the neurology devices market. Both public and private sectors are allocating substantial funds to explore new technologies and treatment modalities for neurological disorders. The National Institutes of Health (NIH) has reported a steady increase in funding for neurological research, which is expected to exceed $2 billion in 2025. This influx of capital fosters innovation and encourages the development of cutting-edge devices that can address unmet medical needs. As new therapies and devices emerge from R&D efforts, the neurology devices market is likely to expand, offering a wider array of solutions for healthcare providers. Furthermore, collaborations between academic institutions and industry players are enhancing the pace of innovation, thereby contributing to market growth.

Supportive Regulatory Environment for Device Approval

A supportive regulatory environment is essential for the growth of the neurology devices market. The US Food and Drug Administration (FDA) has streamlined the approval process for innovative medical devices, encouraging manufacturers to bring new products to market more efficiently. This regulatory support fosters innovation and allows for quicker access to advanced therapies for patients. The FDA's initiatives, such as the Breakthrough Devices Program, aim to expedite the development and review of devices that address unmet medical needs in neurology. As a result, the neurology devices market is likely to see an influx of new products, enhancing treatment options for patients and driving overall market growth. The favorable regulatory landscape not only benefits manufacturers but also ensures that patients receive timely access to cutting-edge technologies.

Growing Awareness and Education on Neurological Health

Raising awareness about neurological health is becoming increasingly important in the US, driving demand for the neurology devices market. Public health campaigns and educational initiatives are informing individuals about the signs and symptoms of neurological disorders, leading to earlier diagnosis and treatment. As awareness increases, more patients are seeking medical attention, which in turn boosts the demand for diagnostic and therapeutic devices. The neurology devices market is likely to benefit from this trend, as healthcare providers are prompted to invest in advanced technologies to meet the needs of a more informed patient population. Additionally, educational programs aimed at healthcare professionals are enhancing their ability to recognize and manage neurological conditions effectively, further supporting market growth.