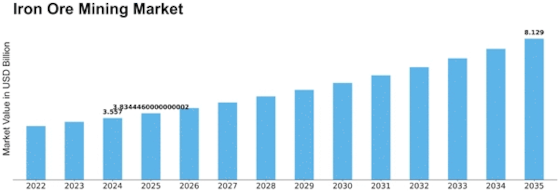

Iron Ore Mining Size

Iron Ore Mining Market Growth Projections and Opportunities

Iron Ore Mining Market Size was valued at USD 3.1 Billion in 2022. The Iron Ore Mining industry is projected to grow from USD 3.3 Billion in 2023 to USD 6.09 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.80%

The iron ore mining market is significantly influenced by various factors that collectively shape its growth and dynamics within the global economy. Economic conditions, steel demand, technological advancements, and geopolitical factors play pivotal roles in determining the trajectory of the iron ore mining industry. Economic stability is a fundamental driver for the iron ore market, as steel production, a major consumer of iron ore, is closely tied to economic growth. During periods of economic expansion, increased construction activities, infrastructure development, and manufacturing contribute to higher steel demand, subsequently driving the demand for iron ore. Conversely, economic downturns may lead to reduced steel production and, consequently, impact the iron ore market negatively.

The demand for steel, a primary driver for iron ore mining, is influenced by the construction and manufacturing sectors. The construction industry, particularly in emerging economies, fuels the demand for steel in infrastructure projects, residential buildings, and commercial structures. Manufacturing, including the automotive and machinery sectors, also contributes significantly to steel demand. Trends in global manufacturing, such as advancements in industrialization and changes in consumer preferences, impact the iron ore market, as steel remains a foundational material in various applications.

Technological advancements in mining processes and steel production contribute to the efficiency and sustainability of iron ore mining operations. Advanced technologies, such as autonomous drilling systems, autonomous haul trucks, and data analytics, improve the precision and productivity of iron ore mining. Innovations in ore processing methods, such as dry processing technologies, reduce water consumption and environmental impact. Additionally, improvements in blast furnace technology and alternative steel production methods impact the overall demand for iron ore.

Environmental considerations are increasingly influencing the iron ore mining market. Responsible mining practices, environmental impact assessments, and adherence to sustainability standards are becoming integral aspects of the industry. The push for eco-friendly and efficient mining methods, waste reduction, and rehabilitation of mined areas contributes to the industry's sustainability. Compliance with stringent environmental regulations and engagement with local communities are essential for maintaining a positive reputation and social responsibility in the iron ore mining sector.

Geopolitical factors also play a role in shaping the iron ore mining market, particularly in terms of access to iron ore resources and trade dynamics. Geopolitical stability in major producing regions, trade policies, and export restrictions can impact iron ore supply chains and pricing. Global trade tensions and geopolitical shifts may influence market dynamics, affecting the reliability of iron ore supply and pricing. Companies in the iron ore mining sector must navigate geopolitical uncertainties to ensure secure access to resources and stable market conditions.

Market competition in the iron ore mining industry is shaped by factors such as production costs, ore quality, and the ability to meet steelmakers' specifications. Mining companies compete based on the quality, purity, and availability of their iron ore deposits. Efficient mining practices, technological innovation, and strategic exploration play crucial roles in maintaining competitiveness. Companies that can balance cost-effective production with responsible environmental and social practices are better positioned to thrive in the competitive iron ore mining market.

Leave a Comment