Increased Cybersecurity Threats

The IT Security Contactless Smart Cards Banking Sector Market is facing heightened cybersecurity threats, which are prompting banks to enhance their security measures. With the rise of sophisticated cyberattacks targeting financial institutions, there is a pressing need for robust IT security solutions. Reports indicate that cybercrime costs the banking sector billions annually, underscoring the urgency for effective security strategies. Consequently, banks are likely to invest more in contactless smart card technologies that offer enhanced security features, thereby fostering growth in the market.

Consumer Awareness and Education

Consumer awareness regarding the importance of security in financial transactions is growing within the IT Security Contactless Smart Cards Banking Sector Market. As individuals become more informed about potential risks associated with payment methods, they are increasingly seeking secure options. Educational initiatives by banks and financial institutions are playing a crucial role in promoting the benefits of contactless smart cards, particularly their security features. This heightened awareness is likely to drive consumer adoption of contactless payment solutions, further propelling the growth of the market.

Regulatory Compliance and Standards

In the IT Security Contactless Smart Cards Banking Sector Market, adherence to regulatory compliance and industry standards is becoming increasingly critical. Financial institutions are required to comply with stringent regulations regarding data protection and transaction security. For instance, the Payment Card Industry Data Security Standard (PCI DSS) mandates robust security measures for payment card transactions. As a result, banks are investing in advanced IT security solutions to ensure compliance, which in turn drives the adoption of contactless smart cards. This focus on regulatory compliance not only enhances security but also builds consumer trust in contactless payment systems.

Rising Demand for Contactless Payments

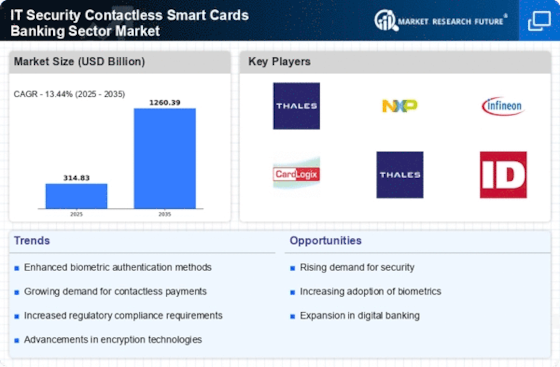

The IT Security Contactless Smart Cards Banking Sector Market is experiencing a notable increase in demand for contactless payment solutions. As consumers increasingly prefer the convenience of tap-and-go transactions, financial institutions are compelled to adopt contactless smart card technology. Recent data indicates that contactless payments accounted for approximately 30% of all card transactions in 2025, reflecting a shift in consumer behavior towards faster and more efficient payment methods. This trend is likely to drive investments in IT security measures to protect sensitive financial information, thereby enhancing the overall security posture of the banking sector.

Technological Advancements in Security Features

The IT Security Contactless Smart Cards Banking Sector Market is significantly influenced by ongoing technological advancements in security features. Innovations such as biometric authentication, encryption, and tokenization are being integrated into contactless smart cards to enhance security. These technologies help mitigate risks associated with fraud and data breaches, which are critical concerns for financial institutions. As the market evolves, the incorporation of these advanced security features is expected to attract more consumers to contactless payment options, thereby driving growth in the sector.