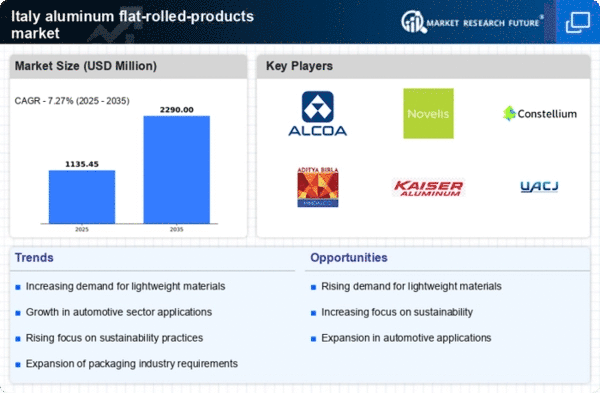

The competitive dynamics within the aluminum flat-rolled-products market in Italy are characterized by a blend of innovation, strategic partnerships, and regional expansion. Key players such as Alcoa Corporation (US),

Novelis Inc. (US), and Constellium SE (FR) are actively shaping the landscape through their distinct operational focuses. Alcoa Corporation (US) emphasizes sustainability and technological advancements, aiming to reduce its carbon footprint while enhancing production efficiency. Novelis Inc. (US), on the other hand, is heavily invested in recycling initiatives, which not only bolster its sustainability credentials but also align with the growing demand for eco-friendly products. Constellium SE (FR) appears to be focusing on strategic partnerships to enhance its product offerings and market reach, particularly in the automotive sector, which is increasingly leaning towards lightweight materials. Collectively, these strategies indicate a competitive environment that is increasingly driven by sustainability and innovation.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance operational efficiency and responsiveness to market demands. The market structure is moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for a diverse range of products and services, catering to different customer needs while fostering competition among established and emerging players.

In October 2025, Novelis Inc. (US) announced a significant investment in a new recycling facility in Italy, aimed at increasing its capacity to produce sustainable aluminum products. This strategic move is likely to enhance Novelis's position in the market by meeting the rising demand for recycled aluminum, which is becoming increasingly critical in various industries, including automotive and packaging. The investment not only underscores Novelis's commitment to sustainability but also positions the company to capitalize on the growing trend towards circular economy practices.

In September 2025, Constellium SE (FR) entered into a partnership with a leading automotive manufacturer to develop advanced aluminum solutions for electric vehicles. This collaboration is indicative of Constellium's strategic focus on innovation and its intent to capture a larger share of the rapidly growing electric vehicle market. By aligning with a key player in the automotive sector, Constellium is likely to enhance its technological capabilities and expand its product portfolio, thereby strengthening its competitive edge.

In August 2025, Alcoa Corporation (US) launched a new line of low-carbon aluminum products, which are designed to meet the stringent sustainability requirements of modern consumers. This initiative reflects Alcoa's proactive approach to addressing environmental concerns while also catering to the increasing demand for sustainable materials. The introduction of these products is expected to not only enhance Alcoa's market presence but also set a benchmark for sustainability in the aluminum industry.

As of November 2025, the competitive trends in the aluminum flat-rolled-products market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are playing a crucial role in shaping the current landscape, enabling companies to leverage each other's strengths and enhance their market offerings. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift suggests that companies that prioritize sustainable practices and technological advancements are likely to emerge as leaders in the market.