Increased Awareness and Education

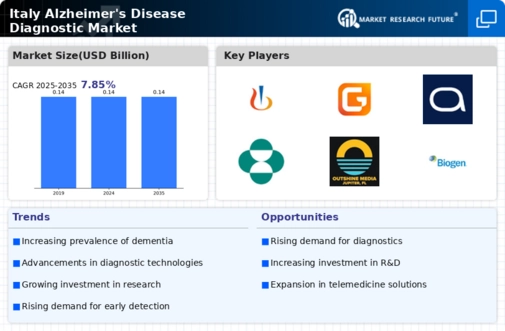

There is a growing awareness and education regarding Alzheimer's disease among the Italian population, which is positively impacting the alzheimers disease-diagnostic market. Public health campaigns and initiatives aimed at educating both healthcare professionals and the general public about the symptoms and importance of early diagnosis are becoming more prevalent. This heightened awareness is likely to lead to increased screening and diagnostic testing, as individuals are more inclined to seek medical advice when they notice symptoms. Moreover, healthcare providers are being trained to recognize early signs of Alzheimer's, which may further drive demand for diagnostic services. As awareness continues to rise, the alzheimers disease-diagnostic market is expected to experience growth in response to the increased demand for early detection and intervention.

Advancements in Biomarker Research

Recent advancements in biomarker research are significantly influencing the alzheimers disease-diagnostic market. Innovative diagnostic methods, such as blood tests and imaging techniques, are being developed to identify biomarkers associated with Alzheimer's disease. These advancements may lead to earlier and more accurate diagnoses, which are essential for effective treatment planning. In Italy, research institutions and universities are increasingly focusing on biomarker studies, which could enhance the diagnostic capabilities available in the market. The potential for these biomarkers to improve patient outcomes may drive demand for diagnostic services and products, thereby expanding the market. As the understanding of Alzheimer's pathology evolves, the alzheimers disease-diagnostic market is likely to benefit from these scientific breakthroughs.

Government Initiatives and Funding

Government initiatives and funding aimed at addressing Alzheimer's disease are crucial drivers for the alzheimers disease-diagnostic market. The Italian government has recognized the need for improved diagnostic services and has allocated resources to enhance research and development in this area. Funding for clinical trials and studies focused on new diagnostic technologies is likely to increase, fostering innovation within the market. Additionally, public health policies that prioritize dementia care and support can lead to the establishment of more comprehensive diagnostic frameworks. These initiatives may not only improve access to diagnostic services but also encourage collaboration between public and private sectors, ultimately benefiting the alzheimers disease-diagnostic market.

Integration of Digital Health Solutions

The integration of digital health solutions into the healthcare system is emerging as a significant driver for the Alzheimer's disease-diagnostic market. Telemedicine and mobile health applications are becoming increasingly popular in Italy, providing patients with easier access to diagnostic services. These digital platforms can facilitate remote consultations and monitoring, which may enhance the efficiency of the diagnostic process. Furthermore, the use of artificial intelligence and machine learning in diagnostic tools is gaining traction, potentially improving accuracy and speed. As healthcare providers adopt these technologies, the alzheimers disease-diagnostic market is likely to expand, driven by the demand for innovative and accessible diagnostic solutions.

Rising Prevalence of Alzheimer's Disease

The increasing prevalence of Alzheimer's disease in Italy is a primary driver for the Alzheimer's disease-diagnostic market. Recent estimates indicate that approximately 1.2 million individuals in Italy are living with dementia, with Alzheimer's being the most common form. This growing patient population necessitates enhanced diagnostic tools and services, as early and accurate diagnosis is crucial for effective management. The Italian healthcare system is under pressure to provide adequate resources for diagnosis, which is likely to stimulate market growth. Furthermore, as the population ages, the incidence of Alzheimer's is expected to rise, potentially increasing the market size significantly. The Alzheimer's disease-diagnostic market is thus positioned to expand in response to these demographic trends.