Government Initiatives and Funding

Government initiatives aimed at improving respiratory health significantly impact the asthma copd-drugs market. In Italy, public health policies are increasingly prioritizing respiratory diseases, leading to enhanced funding for research and development of new therapies. The Italian Ministry of Health has allocated substantial resources to combat asthma and COPD, which may result in the introduction of novel drugs and treatment options. Furthermore, public awareness campaigns are being launched to educate citizens about the importance of early diagnosis and management of respiratory conditions. This proactive approach is likely to increase the patient population seeking treatment, thereby driving demand for asthma copd-drugs. The collaboration between government bodies and pharmaceutical companies could also foster innovation, ensuring that the market remains dynamic and responsive to patient needs.

Rising Awareness of Respiratory Health

The growing awareness of respiratory health among the Italian population is a significant driver for the asthma copd-drugs market. Increased education regarding the symptoms and risks associated with asthma and COPD has led to more individuals seeking medical advice and treatment. Public health campaigns and initiatives by healthcare organizations are effectively raising awareness about the importance of early diagnosis and management of respiratory diseases. This heightened awareness is likely to result in an increase in the number of patients diagnosed and treated, thereby driving demand for asthma copd-drugs. Additionally, as patients become more informed about their treatment options, they may actively seek out newer and more effective therapies, further stimulating market growth. The emphasis on respiratory health is expected to continue, fostering a more proactive approach to managing these chronic conditions.

Advancements in Pharmaceutical Research

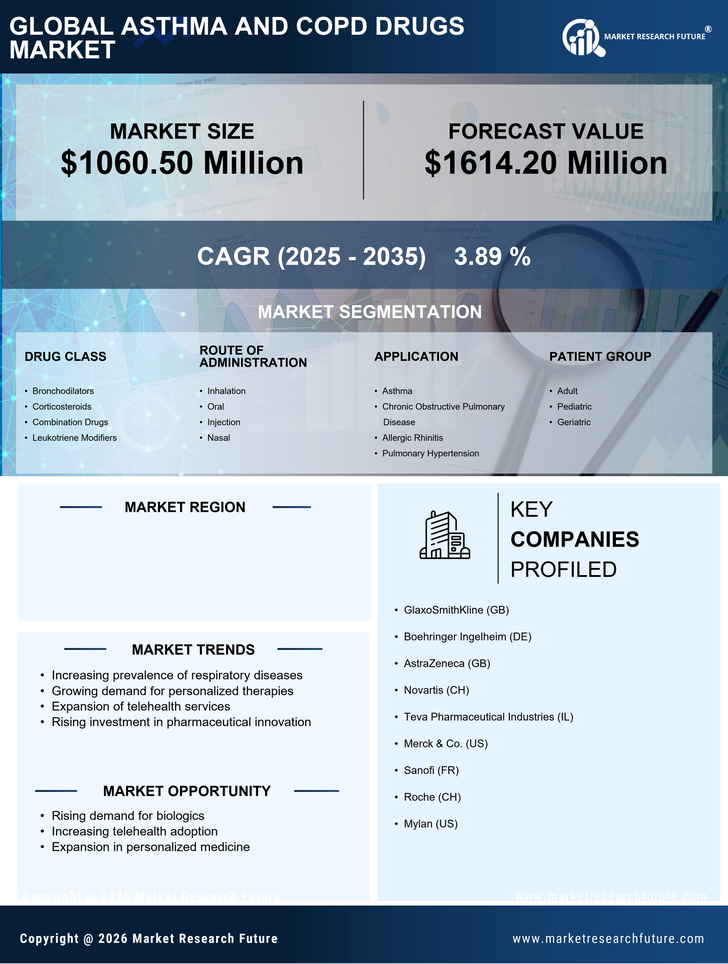

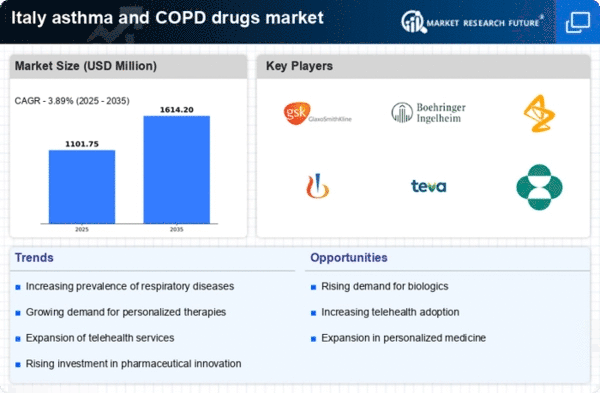

Ongoing advancements in pharmaceutical research are crucial for the evolution of the asthma copd-drugs market. In Italy, research institutions and pharmaceutical companies are increasingly focusing on developing new drug formulations and delivery systems. Innovations such as biologics and targeted therapies are gaining traction, offering more effective treatment options for patients. The market is witnessing a shift towards personalized medicine, where therapies are tailored to individual patient profiles. This trend is supported by clinical trials that demonstrate improved efficacy and safety profiles of new drugs. As a result, the introduction of these advanced therapies is expected to enhance patient outcomes and adherence, thereby expanding the asthma copd-drugs market. The collaboration between academia and industry is likely to accelerate the pace of innovation, ensuring that patients have access to cutting-edge treatments.

Integration of Digital Health Solutions

The integration of digital health solutions into the management of respiratory diseases is emerging as a key driver for the asthma copd-drugs market. In Italy, the adoption of telemedicine and mobile health applications is on the rise, enabling patients to monitor their conditions more effectively. These digital tools facilitate better communication between patients and healthcare providers, allowing for timely interventions and adjustments to treatment plans. As patients gain access to real-time data regarding their respiratory health, adherence to prescribed therapies may improve, positively impacting the asthma copd-drugs market. Furthermore, the use of digital platforms for education and support can empower patients to take an active role in managing their conditions. This trend suggests a shift towards a more patient-centered approach in healthcare, which could enhance the overall effectiveness of asthma and COPD management.

Growing Prevalence of Respiratory Diseases

The increasing incidence of respiratory diseases in Italy is a primary driver for the asthma copd-drugs market. Recent statistics indicate that approximately 3.5 million individuals in Italy suffer from asthma, while COPD affects around 2 million people. This rising prevalence necessitates the development and availability of effective medications, thereby propelling market growth. The aging population, combined with environmental factors such as pollution, contributes to this trend. As more individuals seek treatment for their respiratory conditions, the demand for innovative drugs and therapies is likely to escalate, further stimulating the asthma copd-drugs market. Healthcare providers are increasingly focusing on tailored treatment plans, which may enhance patient outcomes and adherence to therapy, ultimately benefiting the market landscape.