Rising Awareness of Oral Health

In Italy, there is a growing awareness regarding the importance of oral health, which is significantly influencing the dental radiology-imaging-devices market. Public health campaigns and educational initiatives have led to an increase in dental check-ups and preventive care. As individuals become more conscious of their oral health, the demand for diagnostic imaging tools rises. This heightened awareness is reflected in the increasing number of dental visits, with reports indicating a 15% rise in patient consultations over the past few years. Consequently, dental practitioners are investing in advanced imaging technologies to meet the rising demand for accurate diagnostics. This trend is likely to sustain the growth of the dental radiology-imaging-devices market in Italy, as more patients seek comprehensive dental care.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in Italy are positively impacting the dental radiology-imaging-devices market. Funding programs and incentives for dental practices to upgrade their imaging technologies are becoming more prevalent. These initiatives are designed to enhance diagnostic capabilities and ensure that dental professionals have access to the latest imaging tools. As a result, many dental clinics are likely to invest in modern radiology devices, which could lead to a market growth rate of approximately 10% annually. The support from governmental bodies is crucial in fostering an environment conducive to technological advancement in the dental sector.

Increasing Adoption of Digital Imaging

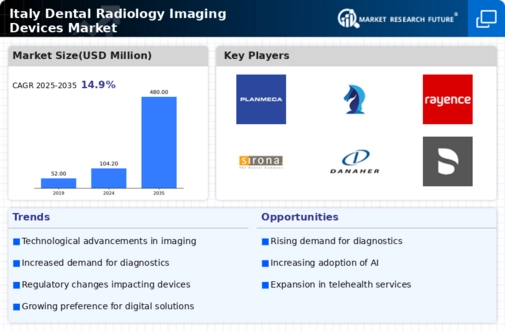

The dental radiology-imaging-devices market in Italy is experiencing a notable shift towards digital imaging technologies. This transition is driven by the advantages of digital systems, such as enhanced image quality, reduced radiation exposure, and improved workflow efficiency. Digital imaging allows for immediate image acquisition and analysis, which is crucial in clinical settings. As of 2025, it is estimated that digital imaging accounts for approximately 70% of the market share in Italy. This trend is likely to continue as dental practices increasingly recognize the benefits of digital solutions over traditional film-based methods. The growing preference for digital imaging is expected to propel the dental radiology-imaging-devices market further, as practitioners seek to enhance diagnostic accuracy and patient care.

Aging Population and Increased Dental Needs

Italy's aging population is contributing to the rising demand for dental services, thereby influencing the dental radiology-imaging-devices market. As the population ages, there is a higher prevalence of dental issues, necessitating more frequent diagnostic imaging. Reports indicate that individuals aged 65 and above are more likely to require dental interventions, leading to an increased need for imaging devices. This demographic shift is expected to drive the market, with projections suggesting a growth of around 12% in the demand for imaging devices over the next five years. The dental radiology-imaging-devices market is likely to benefit from this trend as practitioners adapt to the evolving needs of an older patient population.

Technological Integration in Dental Practices

The integration of advanced technologies in dental practices is a significant driver for the dental radiology-imaging-devices market in Italy. Innovations such as artificial intelligence (AI) and machine learning are being incorporated into imaging devices, enhancing diagnostic capabilities and streamlining workflows. These technologies assist in the analysis of radiographic images, potentially improving the accuracy of diagnoses and treatment planning. As of November 2025, it is projected that approximately 30% of dental practices in Italy will adopt AI-driven imaging solutions. This integration not only improves patient outcomes but also increases operational efficiency, thereby driving the demand for sophisticated imaging devices in the market.