Focus on Patient-Centric Care

The shift towards patient-centric care in Italy is reshaping the handheld surgical-devices market. Healthcare providers are increasingly prioritizing patient outcomes and experiences, leading to a demand for devices that enhance safety and comfort during surgical procedures. This focus on patient-centricity encourages the development of handheld surgical devices that are easier to use, less invasive, and more effective. As hospitals and clinics strive to improve patient satisfaction and reduce hospital stays, the demand for innovative handheld surgical devices is likely to rise. This trend indicates a growing recognition of the importance of patient experience in surgical care, which is a vital driver for the handheld surgical-devices market.

Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in Italy is a pivotal driver for the handheld surgical-devices market. The Italian government has been actively investing in modernizing healthcare facilities, which includes upgrading surgical equipment and technologies. This investment is aimed at improving healthcare delivery and ensuring that medical institutions are equipped with the latest tools to provide high-quality care. As a result, the demand for advanced handheld surgical devices is expected to increase, as hospitals seek to enhance their surgical capabilities. Furthermore, this investment not only supports the growth of the handheld surgical-devices market but also contributes to better patient outcomes and overall healthcare efficiency.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is significantly influencing the handheld surgical-devices market in Italy. Innovations such as robotics, artificial intelligence, and augmented reality are being increasingly incorporated into surgical practices, enhancing the capabilities of handheld devices. For instance, the use of AI in surgical planning and execution can improve outcomes and reduce operation times. The Italian government has been supportive of these technological advancements, providing funding and incentives for research and development in the medical device sector. This technological integration not only improves surgical precision but also drives the demand for sophisticated handheld surgical devices, thereby stimulating market growth.

Aging Population and Increased Surgical Needs

Italy's demographic shift towards an aging population is a critical driver for the handheld surgical-devices market. As the population ages, there is a corresponding increase in the prevalence of chronic diseases and conditions that require surgical intervention. According to recent statistics, approximately 23% of the Italian population is over 65 years old, leading to a higher demand for surgical procedures. This demographic trend necessitates the use of advanced handheld surgical devices that can facilitate complex surgeries with precision and efficiency. The healthcare system is thus compelled to adapt and invest in these devices to cater to the growing surgical needs of the elderly, further propelling the handheld surgical-devices market.

Rising Demand for Minimally Invasive Procedures

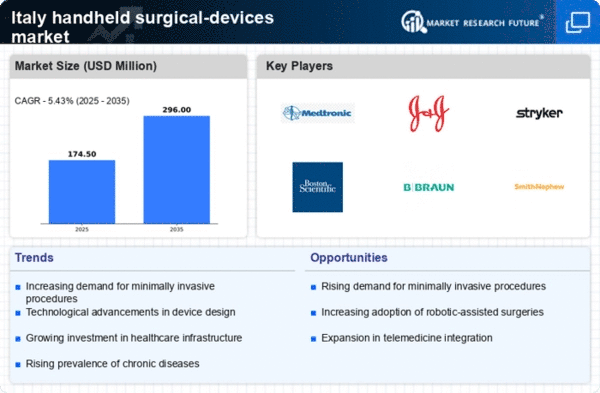

The handheld surgical-devices market in Italy is experiencing a notable surge in demand due to the increasing preference for minimally invasive surgical procedures. These techniques are associated with reduced recovery times, lower risk of complications, and minimal scarring, which appeal to both patients and healthcare providers. As a result, the market for handheld surgical devices is projected to grow at a CAGR of approximately 8% over the next five years. This trend is further supported by advancements in surgical techniques and technologies, which enhance the efficacy and safety of these procedures. Consequently, the rising demand for minimally invasive options is a significant driver for the handheld surgical-devices market, as hospitals and surgical centers invest in innovative tools to meet patient expectations.