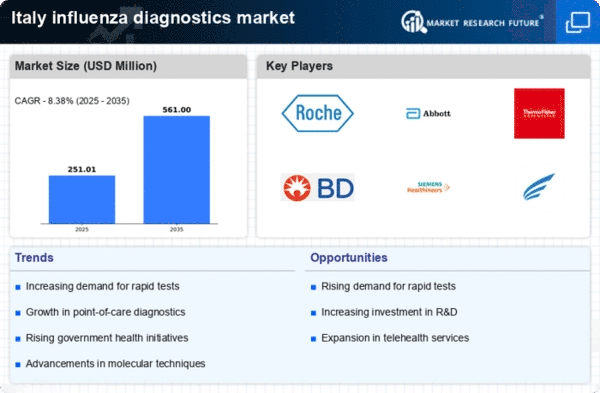

Government Initiatives and Funding

Government initiatives aimed at combating influenza outbreaks significantly influence the influenza diagnostics market. In Italy, public health authorities have allocated substantial funding to enhance diagnostic capabilities and improve surveillance systems. Recent reports indicate that the Italian government has invested over €50 million in influenza research and diagnostics over the past two years. These initiatives not only promote the development of innovative diagnostic tools but also facilitate collaboration between public and private sectors. As a result, the market is witnessing an influx of new technologies and methodologies designed to improve diagnostic accuracy and speed. This government support is crucial for fostering a robust influenza diagnostics market, ensuring that healthcare providers are equipped with the necessary tools to respond effectively to influenza outbreaks.

Rising Incidence of Influenza Cases

The increasing incidence of influenza cases in Italy is a primary driver for the influenza diagnostics market. Seasonal outbreaks and sporadic epidemics contribute to heightened demand for accurate and timely diagnostic tools. According to the Italian Ministry of Health, influenza cases have shown a notable rise, with estimates indicating that approximately 5 million cases occur annually. This surge necessitates the implementation of effective diagnostic solutions to manage public health effectively. Consequently, healthcare providers are investing in advanced diagnostic technologies to ensure rapid identification of influenza strains, thereby enhancing patient outcomes. The influenza diagnostics market is likely to benefit from this trend. Healthcare facilities are seeking to improve their diagnostic capabilities to address the growing burden of influenza.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare in Italy significantly drives the influenza diagnostics market. Public health campaigns aimed at promoting vaccination and early detection of influenza are gaining traction. This shift towards preventive measures encourages individuals to seek diagnostic testing as a proactive approach to managing their health. Recent surveys indicate that approximately 60% of the population is now more aware of the importance of early diagnosis and treatment of influenza. Consequently, healthcare providers are responding by enhancing their diagnostic services, leading to an increase in the availability of influenza testing. This trend is likely to bolster the influenza diagnostics market, as more individuals seek testing to prevent severe illness and complications associated with influenza.

Rising Demand for Home Testing Solutions

The rising demand for home testing solutions is a notable driver in the influenza diagnostics market. With an increasing number of consumers seeking convenience and accessibility in healthcare, home testing kits for influenza are gaining popularity in Italy. These kits allow individuals to conduct tests in the comfort of their homes, providing rapid results and reducing the need for hospital visits. Market analysis suggests that the home testing segment could account for approximately 20% of the overall influenza diagnostics market by 2026. This shift towards home-based testing solutions reflects changing consumer preferences and the desire for more personalized healthcare options. As manufacturers respond to this demand by developing user-friendly and accurate home testing kits, the influenza diagnostics market is poised for growth.

Technological Innovations in Diagnostic Tools

Technological innovations play a pivotal role in shaping the influenza diagnostics market. The introduction of rapid diagnostic tests, molecular assays, and point-of-care testing devices has transformed the landscape of influenza detection in Italy. These advancements enable healthcare professionals to obtain results within hours. These advancements enable healthcare professionals to obtain results within hours, significantly reducing the time required for diagnosis. For instance, the market has seen a rise in the adoption of PCR-based tests, which offer higher sensitivity and specificity compared to traditional methods. As a result, the influenza diagnostics market is experiencing a shift towards more efficient and reliable testing solutions. The continuous evolution of technology in this sector suggests that the market will likely expand further, driven by the demand for faster and more accurate diagnostic options.