The integration platform-as-a-service market in Italy is characterized by a dynamic competitive landscape, driven by the increasing demand for seamless connectivity and data integration across various sectors. Key players such as MuleSoft (US), Dell Boomi (US), and Microsoft (US) are strategically positioned to leverage their technological advancements and extensive service offerings. MuleSoft (US) focuses on enhancing its Anypoint Platform, which facilitates API-led connectivity, thereby enabling organizations to integrate applications and data more efficiently. Meanwhile, Dell Boomi (US) emphasizes its low-code development environment, which appeals to businesses seeking rapid deployment and ease of use. Microsoft (US), with its Azure integration services, aims to provide comprehensive solutions that cater to both small and large enterprises, thus broadening its market reach. Collectively, these strategies foster a competitive environment that prioritizes innovation and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing their operations to better serve the Italian market. This includes optimizing supply chains and enhancing customer support services. The market structure appears moderately fragmented, with several players vying for market share. However, the influence of major companies like Oracle (US) and IBM (US) remains substantial, as they continue to invest in advanced technologies and strategic partnerships to solidify their positions.

In October 2025, Oracle (US) announced the launch of its new cloud-native integration platform, which is designed to streamline enterprise application integration. This move is significant as it positions Oracle (US) to compete more effectively against established players by offering enhanced capabilities that cater to the evolving needs of businesses in Italy. The introduction of this platform is likely to attract organizations looking for robust integration solutions that can scale with their operations.

In September 2025, IBM (US) expanded its partnership with a leading Italian telecommunications provider to enhance its integration services. This collaboration aims to deliver tailored solutions that address the unique challenges faced by local businesses. The strategic importance of this partnership lies in IBM's ability to leverage local expertise while providing cutting-edge technology, thereby strengthening its foothold in the Italian market.

In November 2025, TIBCO Software (US) unveiled a new AI-driven analytics feature within its integration platform. This development is noteworthy as it reflects the growing trend of incorporating artificial intelligence into integration solutions, enabling businesses to gain deeper insights from their data. By enhancing its platform with AI capabilities, TIBCO Software (US) positions itself as a forward-thinking player in the market, likely appealing to data-driven organizations.

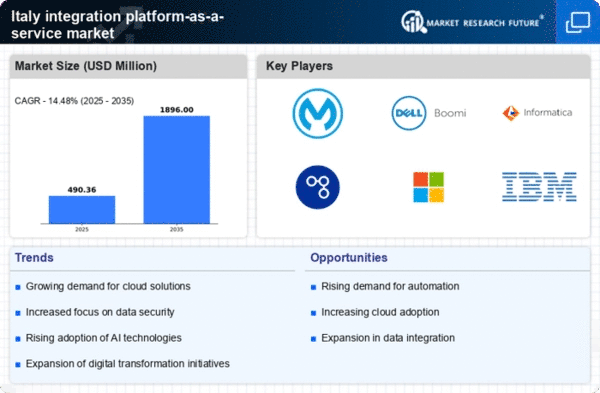

As of November 2025, the integration platform-as-a-service market is witnessing trends that emphasize digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the competitive landscape, fostering innovation and collaboration. Looking ahead, it appears that competitive differentiation will increasingly hinge on technological advancements and the ability to provide reliable supply chain solutions, rather than solely on price. This shift suggests a potential evolution in how companies approach competition, with a greater focus on innovation and customer value.