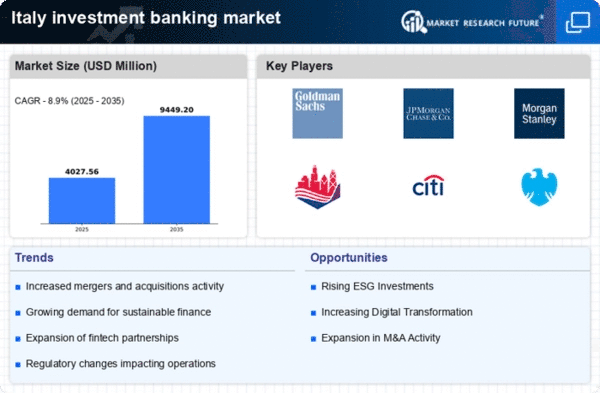

Increased M&A Activity

The investment banking market in Italy is witnessing a significant uptick in mergers and acquisitions (M&A) activity. In 2025, M&A transactions are expected to reach a total value of €30 billion, reflecting a 15% increase from the previous year. This surge is attributed to several factors, including the need for companies to consolidate in a competitive landscape and the availability of favorable financing conditions. Investment banks play a crucial role in advising clients on strategic acquisitions and facilitating these complex transactions. Additionally, the Italian market is becoming increasingly attractive to foreign investors, further driving M&A activity. As companies look to enhance their market position and achieve synergies, the investment banking market is likely to benefit from this trend, positioning itself as a key player in the evolving economic landscape.

Focus on Sustainable Investment Strategies

The investment banking market in Italy is adopting sustainable investment strategies, reflecting a broader global trend towards responsible finance. In 2025, it is estimated that sustainable investments will account for approximately 25% of total assets under management in the Italian financial sector. This shift is driven by growing awareness among investors regarding environmental, social, and governance (ESG) factors. Investment banks are responding by developing products and services that cater to this demand, such as green bonds and ESG-focused funds. Furthermore, regulatory bodies are encouraging sustainable practices, which could further enhance the appeal of sustainable investment strategies. As the market evolves, investment banks that prioritize sustainability may gain a competitive edge, positioning themselves favorably within the investment banking market.

Economic Growth and Investment Opportunities

The investment banking market in Italy is experiencing significant growth due to the country's economic expansion. With GDP growth projected at 2.5% for 2025, there is an increasing demand for capital raising and advisory services. This growth is driven by a resurgence in domestic consumption and a rise in exports, which creates a favorable environment for mergers and acquisitions. As companies seek to expand and innovate, investment banks are positioned to facilitate these transactions, thereby enhancing their role in the market. Furthermore, the Italian government has introduced various incentives to attract foreign investment, which could further stimulate activity in the investment banking market. The combination of economic growth and favorable investment conditions suggests a robust outlook for investment banking services in Italy.

Technological Integration in Financial Services

The investment banking market in Italy is undergoing a transformation driven by technological integration. Financial institutions are increasingly adopting advanced technologies such as artificial intelligence and blockchain to enhance operational efficiency and improve client services. This trend is expected to reshape the competitive landscape, as investment banks that leverage technology can offer more innovative solutions to their clients. For instance, the use of data analytics allows banks to provide tailored financial advice and identify emerging market trends. Moreover, the Italian government is promoting digitalization in the financial sector, which could further accelerate the adoption of technology in investment banking. As firms strive to remain competitive, the integration of technology appears to be a critical driver for growth in the investment banking market.

Regulatory Environment and Compliance Challenges

The investment banking market in Italy is significantly influenced by the evolving regulatory environment. Recent changes in financial regulations have imposed stricter compliance requirements on investment banks, necessitating increased investment in compliance infrastructure. This shift is likely to impact operational costs and profitability, as firms must allocate resources to meet these new standards. Additionally, the European Union's regulatory framework continues to shape the landscape, with directives aimed at enhancing transparency and protecting investors. While these regulations may pose challenges, they also present opportunities for investment banks to differentiate themselves through superior compliance practices. As firms navigate this complex regulatory landscape, the ability to adapt and comply effectively will be a key determinant of success in the investment banking market.