Rising Cancer Incidence

The increasing incidence of cancer in Italy is a primary driver for the liquid biopsy market. According to recent statistics, cancer cases in Italy have been on the rise, with estimates suggesting that approximately 3.5 million individuals are living with cancer. This alarming trend necessitates innovative diagnostic solutions, such as liquid biopsies, which offer non-invasive methods for early detection and monitoring of cancer. The liquid biopsy market is poised to benefit from this growing demand, as healthcare providers seek efficient and effective ways to manage cancer treatment. Furthermore, the potential for liquid biopsies to provide real-time insights into tumor dynamics may enhance patient outcomes, thereby driving further adoption within clinical settings. As the healthcare landscape evolves, the liquid biopsy market is likely to see substantial growth fueled by the urgent need for advanced cancer diagnostics.

Regulatory Framework Enhancements

The evolving regulatory landscape in Italy is playing a pivotal role in shaping the liquid biopsy market. Recent enhancements in regulatory frameworks are aimed at expediting the approval processes for innovative diagnostic tests, including liquid biopsies. This supportive environment encourages companies to invest in the development of new technologies, thereby expanding the liquid biopsy market. Regulatory bodies are increasingly recognizing the clinical value of liquid biopsies, which may lead to more streamlined pathways for market entry. As these regulatory changes take effect, the liquid biopsy market is likely to see an influx of new products and services, enhancing competition and driving innovation. The potential for quicker access to market for effective diagnostic tools could significantly benefit patients, ultimately leading to improved healthcare outcomes in Italy.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is reshaping the landscape of the liquid biopsy market. In Italy, there is a growing recognition of the need for tailored treatment plans that consider individual patient profiles. Liquid biopsies facilitate this approach by providing critical information about tumor genetics and dynamics, enabling oncologists to make informed decisions regarding treatment options. The liquid biopsy market is likely to expand as healthcare providers increasingly adopt these tests to optimize therapeutic strategies. Furthermore, the potential for liquid biopsies to monitor treatment response and detect resistance mutations in real-time enhances their value in personalized medicine. As the healthcare community in Italy embraces this paradigm shift, the liquid biopsy market is expected to witness robust growth, driven by the demand for more effective and individualized cancer care.

Technological Innovations in Diagnostics

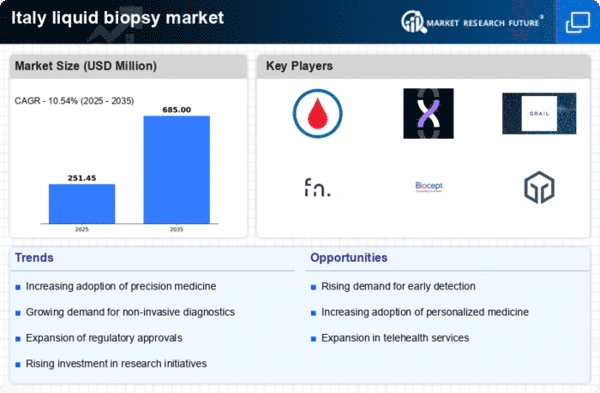

Technological advancements in diagnostic tools are significantly influencing the liquid biopsy market. Innovations such as next-generation sequencing (NGS) and digital PCR are enhancing the sensitivity and specificity of liquid biopsies, making them more appealing to healthcare professionals. In Italy, the liquid biopsy market is experiencing a surge in interest as these technologies become more accessible and affordable. The integration of artificial intelligence and machine learning in data analysis is also streamlining the interpretation of complex genomic data, potentially leading to quicker clinical decisions. As these technologies continue to evolve, they are expected to drive the liquid biopsy market forward, with projections indicating a compound annual growth rate (CAGR) of over 20% in the coming years. This growth reflects the increasing reliance on advanced diagnostic methods in the Italian healthcare system.

Increased Investment in Research and Development

Investment in research and development (R&D) is a crucial driver for the liquid biopsy market. In Italy, both public and private sectors are channeling funds into innovative research aimed at improving liquid biopsy technologies. This influx of capital is fostering collaborations between academic institutions and biotech companies, leading to the development of novel liquid biopsy assays and platforms. The liquid biopsy market stands to gain from these advancements, as new products are introduced that enhance diagnostic capabilities and clinical utility. Moreover, government initiatives aimed at promoting cancer research are likely to further stimulate R&D efforts in this field. As a result, the liquid biopsy market is expected to experience accelerated growth, with new breakthroughs potentially transforming cancer diagnostics and patient management.