Rising Demand for Diagnostic Imaging

The medical imaging software market in Italy experiences a notable increase in demand for diagnostic imaging solutions. This trend is driven by the growing prevalence of chronic diseases and the aging population, which necessitates advanced imaging techniques for accurate diagnosis. According to recent data, the Italian healthcare sector has allocated approximately €2 billion for medical imaging technologies, reflecting a commitment to enhancing diagnostic capabilities. As healthcare providers seek to improve patient outcomes, the integration of sophisticated imaging software becomes essential. This rising demand not only propels the market forward but also encourages innovation in imaging technologies, thereby fostering a competitive landscape within the medical imaging-software market.

Growing Focus on Preventive Healthcare

The medical imaging software market in Italy is increasingly influenced by a growing focus on preventive healthcare. As healthcare systems shift towards proactive measures, the demand for imaging solutions that facilitate early detection of diseases rises. This trend is supported by public health campaigns aimed at educating the population about the importance of regular screenings and check-ups. Consequently, healthcare providers are investing in advanced imaging software to enhance their diagnostic capabilities. The emphasis on preventive care is expected to drive market growth, as more individuals seek imaging services to identify potential health issues before they escalate. This shift not only benefits patients but also strengthens the overall medical imaging-software market.

Technological Advancements in Imaging Software

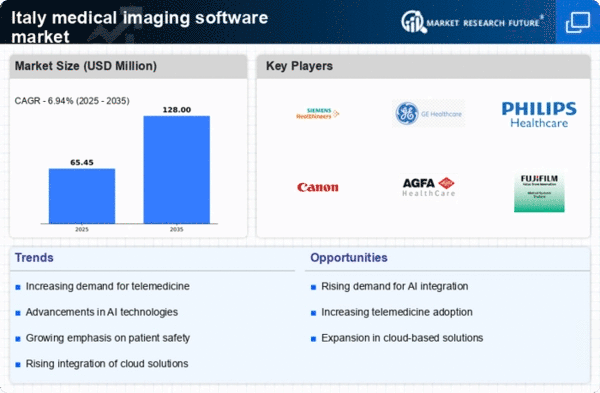

Technological advancements play a pivotal role in shaping the medical imaging-software market in Italy. Innovations such as 3D imaging, enhanced visualization techniques, and cloud-based solutions are transforming the way medical professionals access and interpret imaging data. The introduction of AI-driven algorithms further enhances diagnostic accuracy and efficiency, allowing for quicker decision-making in clinical settings. As of November 2025, the market is projected to grow at a CAGR of 8.5%, driven by these technological advancements. The continuous evolution of imaging software not only improves the quality of care but also positions Italy as a leader in the medical imaging-software market, attracting investments and fostering research and development.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure significantly influences the medical imaging-software market in Italy. The Italian government has prioritized healthcare modernization, allocating substantial funds to upgrade medical facilities and integrate advanced imaging technologies. Recent reports indicate that public and private investments in healthcare are expected to reach €5 billion by 2026, with a significant portion directed towards imaging software solutions. This influx of capital facilitates the adoption of cutting-edge technologies, enhancing the capabilities of healthcare providers. As a result, the medical imaging-software market is likely to expand, driven by improved access to advanced diagnostic tools and a commitment to delivering high-quality healthcare services.

Collaboration Between Healthcare Providers and Tech Companies

Collaboration between healthcare providers and technology companies is emerging as a key driver in the medical imaging-software market in Italy. Partnerships facilitate the development of innovative imaging solutions that address specific healthcare challenges. By leveraging technological expertise, healthcare organizations can enhance their imaging capabilities and improve patient care. Recent collaborations have led to the creation of integrated platforms that streamline imaging workflows and enhance data sharing among medical professionals. This synergy is likely to foster innovation and drive market growth, as the medical imaging-software market adapts to the evolving needs of healthcare providers and patients alike.