Advancements in Technology

Technological advancements are playing a pivotal role in shaping the small cell-networks market in Italy. Innovations such as 5G technology and network virtualization are enabling more efficient and cost-effective deployment of small cells. The introduction of 5G is particularly noteworthy, as it promises to deliver higher speeds and lower latency, which are crucial for applications like IoT and smart cities. As of November 2025, the Italian government has allocated €1 billion to support the rollout of 5G infrastructure, which is expected to significantly boost the small cell-networks market. This investment indicates a strong commitment to enhancing connectivity and fostering technological growth.

Rising Mobile Data Consumption

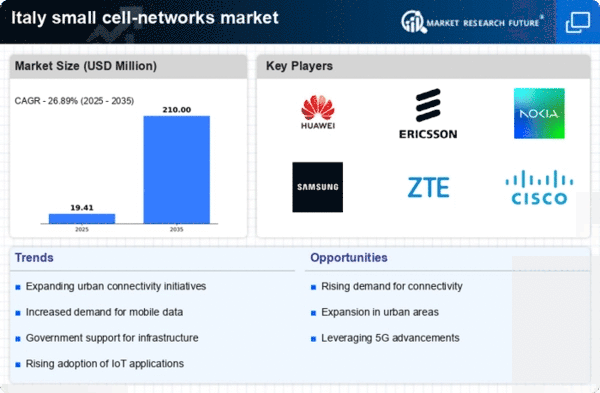

The small cell-networks market in Italy is experiencing a surge in demand driven by the increasing consumption of mobile data. As users engage more with data-intensive applications such as streaming services and online gaming, the need for enhanced network capacity becomes critical. Reports indicate that mobile data traffic in Italy is projected to grow at a CAGR of 30% over the next five years. This trend necessitates the deployment of small cell networks to alleviate congestion in urban areas, ensuring that users receive reliable and high-speed connectivity. Consequently, telecom operators are investing heavily in small cell infrastructure to meet this growing demand, thereby propelling the small cell-networks market forward.

Support for Smart City Developments

The push for smart city initiatives in Italy is significantly influencing the small cell-networks market. As cities aim to enhance urban living through technology, the integration of small cells becomes essential for supporting various smart applications, such as traffic management and public safety. The Italian government has launched several initiatives aimed at fostering smart city projects, which inherently require robust wireless networks. The small cell-networks market is poised to grow as municipalities collaborate with telecom providers to implement these technologies. This alignment between government objectives and market needs suggests a promising future for small cell deployments in urban environments.

Urbanization and Population Density

Italy's ongoing urbanization is a significant driver for the small cell-networks market. With approximately 70% of the population residing in urban areas, the demand for robust wireless connectivity is paramount. High population density in cities like Milan and Rome leads to network congestion, making small cell deployments essential for maintaining service quality. The small cell-networks market is likely to benefit from this trend, as urban planners and telecom providers collaborate to integrate small cells into existing infrastructure. This approach not only enhances coverage but also improves user experience, thereby fostering further growth in the small cell-networks market.

Increased Investment from Telecom Operators

Telecom operators in Italy are increasingly recognizing the value of small cell networks, leading to heightened investment in this sector. As competition intensifies, operators are seeking innovative solutions to differentiate their services. The small cell-networks market is likely to benefit from this trend, as operators deploy small cells to enhance coverage and capacity in high-traffic areas. Recent data suggests that investments in small cell technology could reach €500 million by 2026, reflecting the strategic importance of these networks in meeting consumer demands. This influx of capital is expected to accelerate the development and deployment of small cell infrastructure across Italy.