Regulatory Compliance Pressures

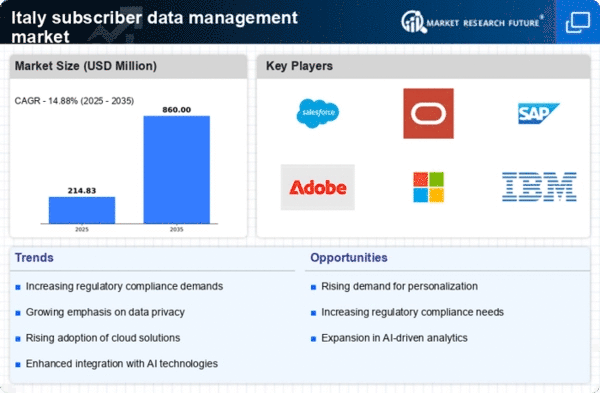

In Italy, the subscriber data-management market faces mounting pressures related to regulatory compliance. The implementation of stringent data protection laws, such as the General Data Protection Regulation (GDPR), necessitates that organizations adopt robust data management practices. Companies are increasingly investing in solutions that ensure compliance, which may lead to a projected market growth of approximately 15% over the next few years. This focus on compliance not only mitigates legal risks but also enhances consumer trust, as businesses demonstrate their commitment to safeguarding subscriber information. Thus, the regulatory landscape significantly influences the dynamics of the subscriber data-management market.

Rising Demand for Personalization

the subscriber data management market in Italy experiences a notable surge in demand for personalized services. As consumers increasingly expect tailored experiences, businesses are compelled to leverage subscriber data to enhance customer engagement. This trend is reflected in the market, where companies that utilize data-driven strategies report up to 30% higher customer retention rates. The ability to analyze subscriber preferences and behaviors allows organizations to create targeted marketing campaigns, thereby improving conversion rates. Consequently, the subscriber data-management market is likely to expand as businesses invest in technologies that facilitate personalized interactions, ensuring they remain competitive in a rapidly evolving landscape.

Increased Investment in Customer Experience

In Italy, there is a growing recognition of the importance of customer experience, which is driving investment in the subscriber data-management market. Organizations are increasingly allocating resources to enhance customer interactions, recognizing that a positive experience can lead to increased loyalty and revenue. This trend is evidenced by a reported 25% increase in budgets dedicated to customer experience initiatives. By utilizing subscriber data effectively, businesses can identify pain points and optimize their service offerings, thereby fostering stronger relationships with their customers. This heightened focus on customer experience is likely to propel the subscriber data-management market forward.

Technological Advancements in Data Processing

the subscriber data management market in Italy is significantly influenced by rapid technological advancements in data processing. Innovations such as artificial intelligence (AI) and machine learning (ML) are transforming how organizations manage and analyze subscriber data. These technologies enable businesses to process vast amounts of data efficiently, leading to improved decision-making and operational efficiency. As a result, the market is projected to grow by 20% in the coming years, driven by the adoption of these advanced technologies. Companies that leverage AI and ML capabilities are likely to gain a competitive edge, enhancing their ability to respond to market demands swiftly.

Emergence of Subscription-Based Business Models

The rise of subscription-based business models in Italy is reshaping the landscape of the subscriber data-management market. As more companies adopt this model, the need for effective data management solutions becomes paramount. Subscription services require ongoing engagement and retention strategies, which rely heavily on accurate subscriber data. This shift is expected to contribute to a market growth rate of approximately 18% over the next few years. Businesses that successfully harness subscriber data to enhance their offerings and maintain customer loyalty are likely to thrive in this evolving environment. Thus, the emergence of subscription models is a key driver of change within the subscriber data-management market.