Emergence of Predictive Analytics

The emergence of predictive analytics is reshaping the telecom analytics market in Italy. By utilizing historical data and advanced algorithms, telecom companies can forecast future trends and customer behaviors with greater accuracy. This capability is particularly valuable in anticipating network demands and optimizing resource allocation. The Italian telecom sector is increasingly adopting predictive analytics to enhance decision-making processes, reduce operational costs, and improve customer engagement. As operators strive to provide seamless connectivity and personalized services, the role of predictive analytics becomes more pronounced. The market for predictive analytics in telecommunications is projected to grow significantly, with estimates suggesting a CAGR of around 7.5% over the next five years. This trend indicates that the adoption of predictive analytics is likely to be a key driver in the telecom analytics market, as firms seek to harness the power of data for strategic advantage.

Integration of Advanced Technologies

The integration of advanced technologies such as IoT and 5G is significantly influencing the telecom analytics market in Italy. With the rollout of 5G networks, telecom operators are presented with unprecedented opportunities to collect and analyze data at an accelerated pace. This technological advancement enables real-time analytics, which is crucial for managing network traffic and enhancing user experiences. The Italian government has invested heavily in 5G infrastructure, with an estimated budget of €6 billion allocated for its development. As a result, telecom companies are increasingly adopting analytics solutions to harness the potential of these technologies, leading to improved service delivery and operational efficiencies. The synergy between advanced technologies and analytics is likely to propel growth in the telecom analytics market, as firms adapt to the demands of a more connected world.

Growing Focus on Regulatory Compliance

In Italy, the growing focus on regulatory compliance is emerging as a significant driver for the telecom analytics market. Telecom operators are required to adhere to stringent regulations regarding data privacy and security, particularly in light of the GDPR. This regulatory landscape compels companies to invest in analytics solutions that ensure compliance while also providing insights into customer data usage. The telecom analytics market is expected to benefit from this trend, as firms seek to implement robust analytics frameworks that not only meet regulatory requirements but also enhance operational transparency. The potential financial penalties for non-compliance, which can reach up to €20 million or 4% of annual global turnover, further incentivize companies to adopt analytics tools that facilitate adherence to these regulations. Thus, the emphasis on compliance is likely to drive growth in the telecom analytics market.

Rising Demand for Data-Driven Insights

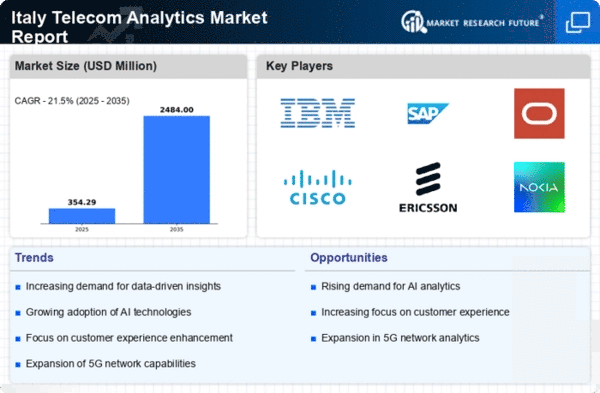

the telecom analytics market in Italy is experiencing a notable surge in demand for data-driven insights.. As telecommunications companies strive to enhance operational efficiency, they increasingly rely on analytics to interpret vast amounts of data generated by users. This trend is underscored by the fact that the Italian telecom sector is projected to grow at a CAGR of approximately 5.2% from 2025 to 2030. Companies are leveraging analytics to optimize network performance, reduce churn rates, and improve customer satisfaction. The ability to analyze customer behavior and preferences allows telecom operators to tailor their services, thereby driving revenue growth. Consequently, the rising demand for actionable insights is a key driver in the telecom analytics market, as firms seek to remain competitive in a rapidly evolving landscape.

Increased Competition Among Telecom Providers

the competitive landscape among telecom providers in Italy is intensifying, driving the telecom analytics market.. As companies vie for market share, they are increasingly turning to analytics to gain insights into customer preferences and market trends. This competitive pressure encourages operators to enhance their service offerings and optimize pricing strategies based on data analysis. The Italian telecom market is characterized by a mix of established players and new entrants, leading to a dynamic environment where customer retention is paramount. Analytics tools enable companies to identify at-risk customers and implement targeted retention strategies, which are essential for maintaining a competitive edge. Consequently, the heightened competition within the telecom sector is a critical driver for the telecom analytics market, as firms seek to leverage data to inform their strategic decisions.

Leave a Comment