Integration of IoT with AI Technologies

The convergence of IoT and artificial intelligence (AI) is reshaping the agile iot market in Japan. This integration allows for enhanced automation and predictive analytics, which are crucial for businesses aiming to optimize their operations. In 2025, the AI in IoT market is expected to surpass $2 billion, indicating a robust growth trajectory. The agile iot market benefits from this synergy, as AI-driven solutions enable organizations to analyze vast amounts of data efficiently. This capability not only streamlines processes but also fosters innovation, allowing companies to develop new products and services that meet evolving consumer demands. As AI technologies continue to advance, their incorporation into agile iot frameworks is likely to become a standard practice.

Rising Demand for Real-Time Data Processing

The agile iot market in Japan experiences a notable surge in demand for real-time data processing capabilities. As industries increasingly rely on instantaneous data for decision-making, the need for agile methodologies becomes paramount. In 2025, the market for real-time data analytics is projected to reach approximately $1.5 billion, reflecting a growth rate of around 25% annually. This trend is driven by sectors such as manufacturing and logistics, where timely insights can enhance operational efficiency. The agile iot market is thus positioned to capitalize on this demand, offering solutions that facilitate rapid data processing and analysis. Companies that adopt agile practices are likely to gain a competitive edge, as they can swiftly adapt to changing market conditions and customer needs.

Expansion of 5G Networks Enhancing Connectivity

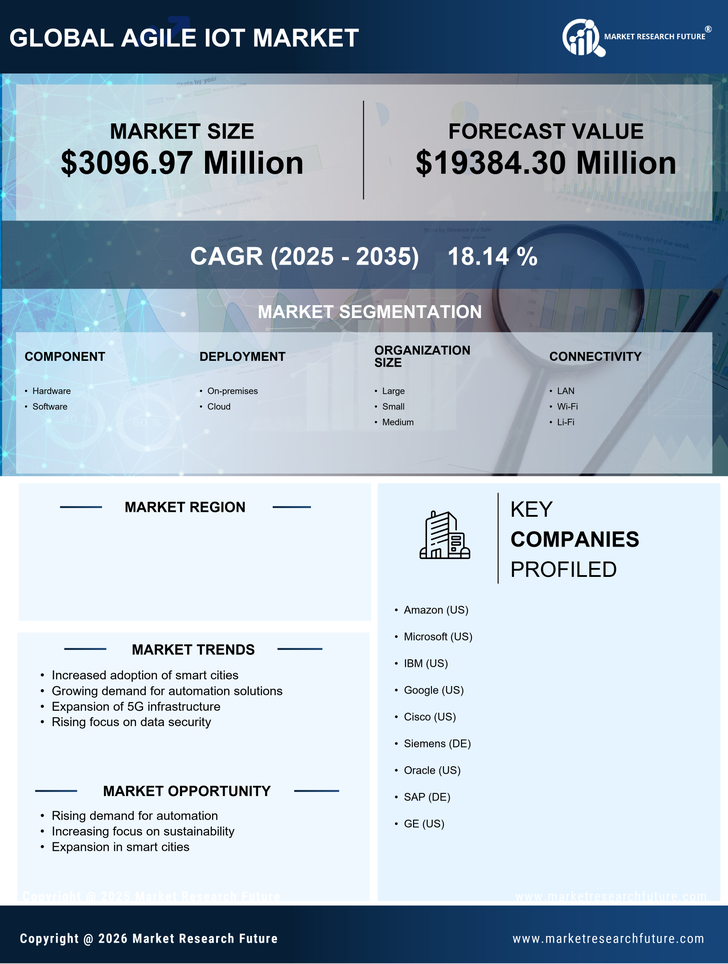

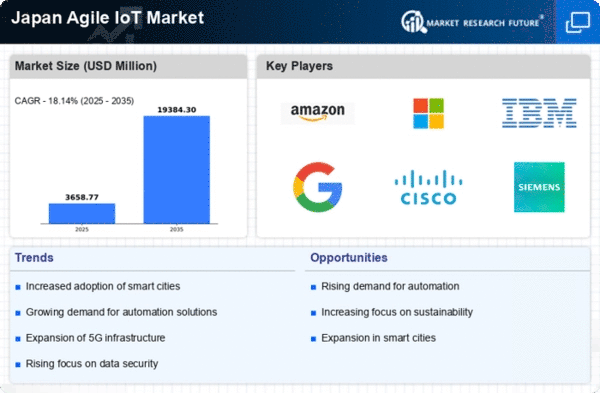

The rollout of 5G networks in Japan is poised to significantly impact the agile iot market by providing enhanced connectivity and faster data transmission. This technological advancement enables more devices to connect seamlessly, facilitating the deployment of IoT solutions across various industries. In 2025, the 5G market is expected to reach $3 billion, underscoring its importance in the agile iot market. The increased bandwidth and reduced latency associated with 5G technology allow for more sophisticated applications, such as smart cities and autonomous vehicles. As businesses leverage these capabilities, the agile iot market is likely to experience accelerated growth, driven by the demand for innovative solutions that capitalize on the advantages of 5G connectivity.

Government Initiatives Supporting IoT Innovation

The Japanese government actively promotes innovation within the agile iot market through various initiatives and funding programs. These efforts aim to enhance the country's technological infrastructure and encourage the adoption of IoT solutions across multiple sectors. In 2025, government investments in IoT-related projects are projected to exceed $500 million, reflecting a commitment to fostering a conducive environment for agile methodologies. The agile iot market stands to benefit significantly from these initiatives, as they provide financial support and resources for research and development. Furthermore, collaboration between public and private sectors is likely to accelerate the deployment of IoT technologies, ultimately driving market growth and enhancing Japan's competitive position in the global landscape.

Growing Focus on Sustainability and Energy Efficiency

Sustainability has emerged as a critical driver within the agile iot market in Japan, as businesses increasingly prioritize energy efficiency and environmental responsibility. The agile iot market is witnessing a shift towards solutions that minimize resource consumption and reduce carbon footprints. In 2025, the market for IoT-enabled energy management systems is anticipated to reach $800 million, reflecting a growing awareness of sustainable practices. Companies that integrate agile methodologies into their operations are better equipped to implement these solutions, as they can quickly adapt to new sustainability standards and regulations. This focus on eco-friendly practices not only enhances corporate reputation but also aligns with consumer preferences for environmentally conscious products.