Rising Industrial Automation

The increasing trend of industrial automation in Japan is driving the air operated-double-diaphragm-pumps market. As industries seek to enhance efficiency and reduce labor costs, the demand for automated systems, including pumps, is on the rise. This shift is particularly evident in sectors such as manufacturing and chemical processing, where precise fluid handling is crucial. The air operated-double-diaphragm-pumps market is expected to benefit from this trend, as these pumps offer reliability and ease of integration into automated systems. Furthermore, the market is projected to grow at a CAGR of approximately 6% over the next five years, reflecting the growing reliance on automated solutions in various industries.

Increased Focus on Safety Standards

The emphasis on safety standards in industrial operations is a key driver for the air operated-double-diaphragm-pumps market in Japan. Industries are increasingly prioritizing safety protocols to prevent accidents and ensure compliance with stringent regulations. Air operated-double-diaphragm pumps are known for their safe operation, as they minimize the risk of leaks and spills, which is critical in hazardous environments. This focus on safety is likely to propel the market forward, as companies invest in equipment that meets or exceeds safety requirements, potentially leading to a market growth rate of around 4% annually.

Growth in Chemical Processing Sector

The chemical processing sector in Japan is experiencing robust growth, which is positively impacting the air operated-double-diaphragm-pumps market. As the demand for chemicals continues to rise, driven by various applications in pharmaceuticals, agriculture, and manufacturing, the need for efficient fluid transfer solutions becomes paramount. Air operated-double-diaphragm pumps are particularly suited for handling corrosive and viscous fluids, making them essential in this sector. The market is projected to expand significantly, with estimates suggesting an increase in market size by approximately 7% over the next few years, driven by the expanding chemical industry.

Environmental Sustainability Initiatives

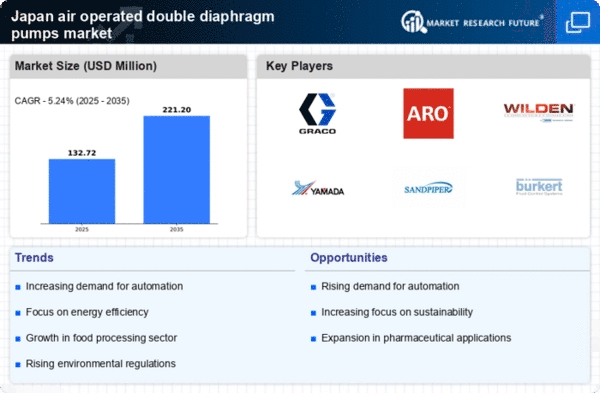

Japan's commitment to environmental sustainability is influencing the air operated-double-diaphragm-pumps market. With increasing regulations aimed at reducing carbon emissions and promoting eco-friendly practices, industries are compelled to adopt more sustainable technologies. Air operated-double-diaphragm pumps are recognized for their energy efficiency and reduced waste generation, making them an attractive option for companies striving to meet environmental standards. The market is likely to see a surge in demand as businesses align their operations with sustainability goals, potentially leading to a market growth of around 5% annually as companies invest in greener technologies.

Technological Innovations in Pump Design

Technological innovations in pump design are significantly influencing the air operated-double-diaphragm-pumps market. Advances in materials and engineering have led to the development of more efficient and durable pumps, which are increasingly favored by industries in Japan. These innovations not only enhance performance but also reduce maintenance costs, making air operated-double-diaphragm pumps a cost-effective solution for fluid transfer. As industries continue to seek improved operational efficiency, the market is expected to grow, with projections indicating a potential increase of 6% in market size over the next few years, driven by these technological advancements.