Emergence of Hybrid Cloud Solutions

The Japan Application Server Market is witnessing the emergence of hybrid cloud solutions as organizations seek to balance the benefits of both public and private cloud environments. This trend is driven by the need for greater control over data and applications while still leveraging the scalability and cost-effectiveness of public cloud services. According to recent market analysis, the hybrid cloud segment is expected to account for over 40% of the total cloud market in Japan by 2026. As businesses increasingly adopt hybrid cloud strategies, the demand for application servers that can seamlessly integrate with both environments is likely to grow. This shift presents a significant opportunity for the Japan Application Server Market, as providers develop solutions that cater to the evolving needs of their clients.

Focus on Enhanced Security Features

The Japan Application Server Market is increasingly focusing on enhanced security features as cyber threats continue to evolve. Organizations are prioritizing the protection of sensitive data and ensuring compliance with stringent regulations, such as the Personal Information Protection Act (PIPA) in Japan. As a result, application server providers are integrating advanced security measures, including encryption, access controls, and threat detection capabilities, into their offerings. Market data suggests that the demand for secure application servers is on the rise, with a projected increase in spending on security solutions by approximately 15% over the next three years. This emphasis on security is likely to shape the future landscape of the Japan Application Server Market, as businesses seek to safeguard their digital assets.

Growing Demand for Digital Transformation

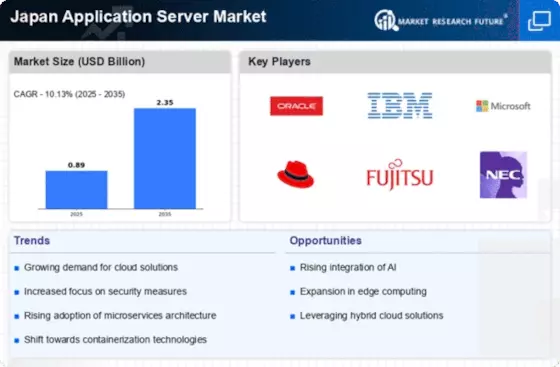

The Japan Application Server Market is experiencing a notable surge in demand driven by the ongoing digital transformation across various sectors. Organizations in Japan are increasingly adopting application servers to enhance operational efficiency and improve customer engagement. According to recent data, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is largely attributed to the need for businesses to modernize their IT infrastructure, enabling them to leverage advanced technologies such as artificial intelligence and big data analytics. As companies strive to remain competitive in a rapidly evolving digital landscape, the adoption of application servers becomes essential, thereby propelling the Japan Application Server Market forward.

Increased Investment in IT Infrastructure

The Japan Application Server Market is benefiting from increased investments in IT infrastructure by both public and private sectors. The Japanese government has been actively promoting initiatives aimed at enhancing the country's technological capabilities, which includes substantial funding for IT projects. In 2025, it was reported that IT spending in Japan reached approximately 1 trillion USD, with a significant portion allocated to application servers. This investment is expected to facilitate the deployment of robust application server solutions, enabling organizations to support their growing digital needs. As businesses seek to optimize their operations and improve service delivery, the demand for application servers is likely to rise, further stimulating growth in the Japan Application Server Market.

Rising Need for Scalability and Flexibility

The Japan Application Server Market is witnessing a rising need for scalability and flexibility among enterprises. As businesses expand and evolve, they require application servers that can adapt to changing demands and support a growing number of users and applications. This trend is particularly evident in sectors such as e-commerce and finance, where the ability to scale operations quickly is crucial. The market data indicates that companies are increasingly opting for cloud-based application servers, which offer enhanced scalability and flexibility compared to traditional on-premises solutions. This shift is likely to drive further growth in the Japan Application Server Market, as organizations seek to implement solutions that can accommodate their dynamic business environments.