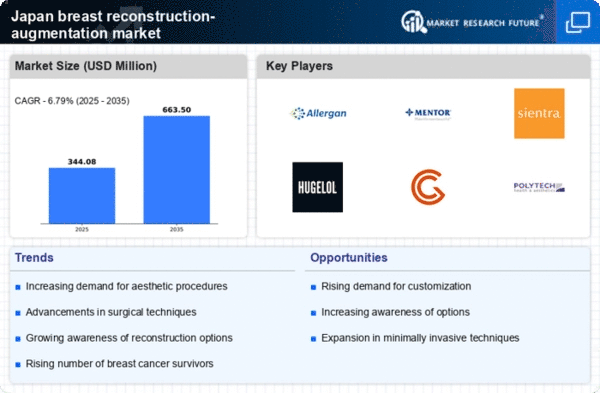

The breast reconstruction-augmentation market in Japan is characterized by a dynamic competitive landscape, driven by increasing consumer awareness and advancements in surgical techniques. Key players such as Allergan (US), Mentor Worldwide (US), and Hugel (KR) are at the forefront, each adopting distinct strategies to enhance their market presence. Allergan (US) focuses on innovation, particularly in developing new implant technologies that cater to diverse patient needs, while Mentor Worldwide (US) emphasizes partnerships with healthcare providers to improve patient education and outcomes. Hugel (KR), on the other hand, is expanding its footprint through regional collaborations, aiming to leverage local expertise and distribution networks, which collectively shapes a competitive environment that is both innovative and responsive to market demands.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and enhance supply chain efficiency. The market structure appears moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This competitive structure allows for a variety of product offerings, catering to different consumer preferences and price points, which is essential in a market where patient choice is paramount.

In October 2025, Allergan (US) announced the launch of a new line of silicone gel implants designed to mimic natural breast tissue more closely. This strategic move is significant as it addresses growing consumer demand for more natural-feeling options, potentially enhancing patient satisfaction and driving sales. The introduction of these implants may also position Allergan (US) as a leader in innovation within the market, setting a benchmark for competitors.

In September 2025, Mentor Worldwide (US) expanded its educational initiatives by partnering with leading plastic surgeons to develop a comprehensive training program for healthcare professionals. This initiative is crucial as it not only enhances the skill set of practitioners but also fosters trust and credibility among patients, thereby potentially increasing the adoption of their products. Such strategic partnerships may strengthen Mentor's market position by ensuring that their products are used effectively and safely.

In August 2025, Hugel (KR) secured a distribution agreement with a prominent Japanese medical device company, significantly enhancing its market access. This agreement is likely to facilitate a more robust supply chain and improve product availability, which is essential in meeting the rising demand for breast reconstruction-augmentation solutions. By leveraging local distribution channels, Hugel (KR) may enhance its competitive edge in the region.

As of November 2025, current trends in the market include a strong emphasis on digitalization, sustainability, and the integration of AI technologies in product development and patient care. Strategic alliances are increasingly shaping the competitive landscape, allowing companies to pool resources and expertise. Looking ahead, it appears that competitive differentiation will evolve, shifting from price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition may redefine how companies position themselves in the market, emphasizing the importance of quality and patient outcomes over mere cost considerations.