Government Funding and Support

Government initiatives and funding programs play a pivotal role in shaping the car t-cell-therapy market. In Japan, the government has recognized the potential of CAR T-cell therapies in addressing unmet medical needs, particularly in oncology. Substantial financial support is being allocated to research and development projects, with recent budgets indicating an increase of over 15% in funding for cancer therapies. This financial backing not only facilitates clinical trials but also encourages collaboration between academic institutions and industry players. As a result, the car t-cell-therapy market is likely to benefit from accelerated innovation and faster regulatory approvals, ultimately enhancing patient access to these groundbreaking therapies. The proactive stance of the government in supporting CAR T-cell therapy initiatives is expected to significantly influence market dynamics in the coming years.

Advancements in Cellular Engineering

Technological advancements in cellular engineering are transforming the car t-cell-therapy market. Innovations in gene editing techniques, such as CRISPR and TALEN, have enhanced the efficacy and safety profiles of CAR T-cell therapies. In Japan, research institutions and biotech companies are increasingly investing in these technologies, leading to the development of next-generation CAR T-cell products. The market is witnessing a surge in clinical trials, with over 50 ongoing studies aimed at optimizing CAR T-cell therapies for various malignancies. This focus on innovation is expected to drive market growth, as improved therapies may lead to higher success rates and better patient outcomes. The integration of advanced cellular engineering techniques is likely to position Japan as a leader in the car t-cell-therapy market, fostering a competitive environment that encourages further research and development.

Enhanced Clinical Outcomes and Patient Demand

The car t-cell-therapy market is significantly driven by the enhanced clinical outcomes associated with these therapies. Clinical trials have demonstrated remarkable efficacy in treating refractory cancers, with response rates exceeding 80% in some cases. This success has led to increased patient demand for CAR T-cell therapies in Japan, as patients and healthcare providers seek effective alternatives to traditional treatments. The positive clinical data is likely to influence treatment guidelines and encourage wider adoption of CAR T-cell therapies across oncology practices. As awareness of these therapies grows, the car t-cell-therapy market is expected to expand, with projections indicating a potential increase in market size by over 30% in the next five years. The combination of improved outcomes and rising patient expectations is poised to shape the future landscape of the car t-cell-therapy market.

Rising Incidence of Hematological Malignancies

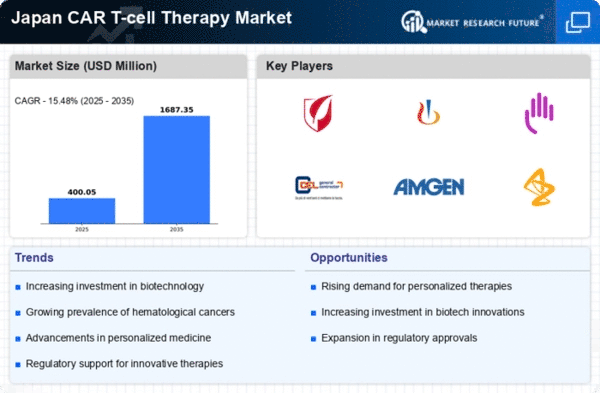

The increasing prevalence of hematological malignancies in Japan is a crucial driver for the car t-cell-therapy market. Reports indicate that the incidence of blood cancers, such as leukemia and lymphoma, has been on the rise, with estimates suggesting that approximately 30,000 new cases are diagnosed annually. This growing patient population necessitates innovative treatment options, thereby propelling the demand for advanced therapies like CAR T-cell therapy. As healthcare providers seek effective solutions, the car t-cell-therapy market is likely to expand significantly, with projections indicating a potential market growth rate of over 20% annually in the coming years. The urgency to address these malignancies underscores the importance of CAR T-cell therapies in the treatment landscape, making it a pivotal factor in the market's evolution.

Growing Investment from Biopharmaceutical Companies

The car t-cell-therapy market is experiencing a surge in investment from biopharmaceutical companies, which is a key driver of market growth. Major players are increasingly recognizing the potential of CAR T-cell therapies, leading to strategic partnerships and acquisitions aimed at enhancing their product portfolios. In Japan, investments in CAR T-cell therapy research have reportedly increased by over 25% in the last two years, reflecting a strong commitment to advancing this innovative treatment modality. This influx of capital is likely to accelerate the development of new therapies and improve manufacturing processes, thereby expanding the market. Furthermore, as competition intensifies, companies are motivated to innovate, which could lead to more effective and accessible CAR T-cell therapies for patients in need.