Focus on Patient-Centric Care

The shift towards patient-centric care in Japan is significantly impacting the clinical alarm-management market. Healthcare providers are increasingly prioritizing patient comfort and safety, leading to the adoption of more sophisticated alarm systems that minimize unnecessary disturbances. This focus on patient experience is driving investments in alarm technologies that are not only effective but also considerate of patients' needs. As hospitals strive to create a healing environment, the clinical alarm-management market is likely to see a growth rate of around 12% annually, reflecting the importance of integrating patient feedback into alarm management strategies.

Regulatory Compliance and Standards

The clinical alarm-management market is significantly influenced by stringent regulatory requirements and standards set by health authorities. These regulations aim to enhance patient safety and ensure effective alarm management systems are in place. Compliance with these standards often necessitates hospitals to invest in advanced alarm technologies and training programs. As of 2025, it is estimated that approximately 70% of healthcare facilities in Japan are actively upgrading their alarm systems to meet these regulatory demands. This trend not only drives the adoption of new technologies but also fosters a culture of safety within healthcare institutions, thereby propelling the clinical alarm-management market.

Economic Factors and Healthcare Budgets

Economic considerations play a pivotal role in shaping the clinical alarm-management market in Japan. With healthcare budgets under constant scrutiny, hospitals are compelled to optimize their spending while ensuring high-quality patient care. This economic pressure drives the need for cost-effective alarm management solutions that do not compromise on safety. As healthcare facilities seek to balance budget constraints with the need for advanced alarm systems, the market is expected to grow by approximately 10% over the next few years. This trend highlights the importance of developing affordable yet efficient alarm management technologies within the clinical alarm-management market.

Technological Advancements in Alarm Systems

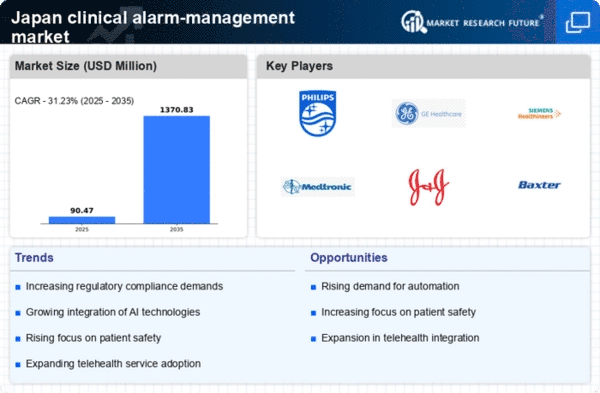

The clinical alarm-management market is experiencing a surge in technological advancements, which are reshaping how alarms are managed in healthcare settings. Innovations such as wireless monitoring systems, artificial intelligence, and data analytics are being integrated into alarm systems to enhance their effectiveness. These technologies allow for real-time monitoring and predictive analytics, which can reduce alarm fatigue among healthcare staff. As of 2025, it is estimated that the adoption of these advanced technologies could lead to a 30% reduction in false alarms, thereby improving patient outcomes and operational efficiency. This trend indicates a robust growth trajectory for the clinical alarm-management market.

Aging Population and Increased Healthcare Demand

Japan's demographic shift towards an aging population is a critical driver for the clinical alarm-management market. With over 28% of the population aged 65 and older, there is a heightened demand for healthcare services, particularly in hospitals and long-term care facilities. This demographic trend necessitates the implementation of efficient alarm systems to monitor patients effectively. The market is projected to grow by approximately 15% annually as healthcare providers seek to enhance patient monitoring capabilities. Consequently, the clinical alarm-management market is poised to expand significantly, driven by the need for improved patient care and safety in response to the increasing healthcare demands.