Health Consciousness

The rising health consciousness among Japanese consumers is influencing their coffee consumption habits, thereby impacting the coffee machines market. With an increasing focus on wellness, many individuals are opting for healthier coffee options, such as organic and low-acid varieties. This trend is prompting manufacturers to develop machines that cater to health-oriented consumers, such as those that allow for cold brew or nitro coffee preparation. Market data indicates that the demand for machines that support these brewing methods has increased by 10% in the last year. As health trends continue to evolve, the coffee machines market may see a shift towards products that promote healthier coffee experiences.

Growing Coffee Culture

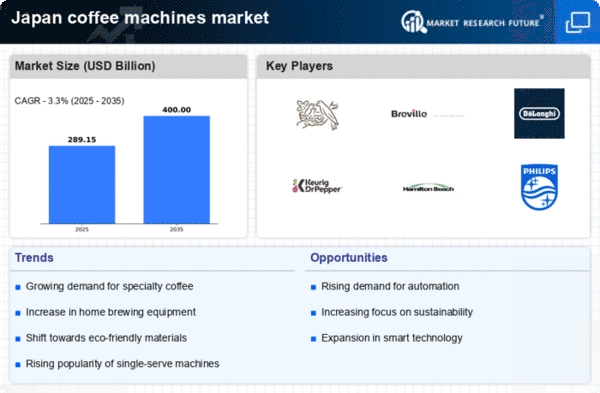

The coffee culture in Japan has been evolving, with an increasing number of consumers embracing specialty coffee and artisanal brewing methods. This trend is reflected in the coffee machines market, where demand for high-quality machines that can replicate café-style beverages at home is on the rise. According to recent data, the market for coffee machines in Japan is projected to grow at a CAGR of approximately 5.5% over the next five years. This growth is driven by a younger demographic that values quality and convenience, leading to a surge in sales of espresso machines and single-serve coffee makers. As consumers become more discerning about their coffee choices, the coffee machines market is likely to see a shift towards premium products that offer advanced features and customization options.

Increased Home Brewing

The trend of home brewing has gained momentum in Japan, particularly as consumers seek to recreate café experiences in the comfort of their homes. This shift is significantly impacting the coffee machines market, as individuals invest in machines that provide versatility and quality. Data indicates that sales of drip coffee makers and espresso machines have increased by over 20% in the past year alone. The convenience of brewing coffee at home, coupled with the desire for high-quality beverages, suggests that the coffee machines market will continue to expand. Furthermore, the availability of various brewing methods, such as pour-over and French press, is likely to attract a broader audience, enhancing the overall market landscape.

Sustainability Initiatives

Sustainability initiatives are becoming increasingly relevant in Japan, influencing consumer preferences in the coffee machines market. As awareness of environmental issues grows, consumers are seeking machines that are energy-efficient and made from sustainable materials. This shift is prompting manufacturers to innovate and produce eco-friendly coffee machines that align with consumer values. Recent surveys indicate that approximately 30% of consumers are willing to pay a premium for sustainable products. Consequently, the coffee machines market is likely to experience growth in the segment of eco-conscious appliances, as brands that prioritize sustainability may gain a competitive edge.

Technological Advancements

Technological advancements play a crucial role in shaping the coffee machines market in Japan. Innovations such as smart coffee machines that can be controlled via mobile applications are becoming increasingly popular. These machines offer features like programmable brewing times and customizable settings, appealing to tech-savvy consumers. The integration of IoT technology in coffee machines is expected to drive market growth, as it enhances user experience and convenience. Recent statistics suggest that the segment of smart coffee machines is expected to grow by approximately 15% annually. As consumers seek more efficient and user-friendly options, the coffee machines market is likely to witness a surge in demand for technologically advanced products.