The contact center-as-a-service market in Japan is characterized by a dynamic competitive landscape, driven by rapid technological advancements and evolving customer expectations. Major players such as Five9 (US), RingCentral (US), and Genesys (US) are actively shaping the market through strategic initiatives focused on innovation and regional expansion. Five9 (US) emphasizes cloud-based solutions, enhancing customer engagement through AI-driven analytics, while RingCentral (US) leverages its unified communications platform to integrate contact center functionalities seamlessly. Genesys (US) is notable for its commitment to omnichannel experiences, positioning itself as a leader in customer journey orchestration. Collectively, these strategies foster a competitive environment that prioritizes customer-centric solutions and technological integration.

Key business tactics within this market include localizing services to meet specific regional demands and optimizing supply chains to enhance operational efficiency. The competitive structure appears moderately fragmented, with numerous players vying for market share. However, the influence of key players is substantial, as they set benchmarks for service quality and technological innovation, thereby shaping customer expectations and industry standards.

In October 2025, Five9 (US) announced a strategic partnership with a leading AI firm to enhance its predictive analytics capabilities. This move is likely to bolster its service offerings, allowing clients to leverage data-driven insights for improved customer interactions. The partnership underscores Five9's commitment to integrating advanced technologies into its platform, potentially giving it a competitive edge in a market increasingly focused on AI-driven solutions.

In September 2025, RingCentral (US) launched a new suite of tools designed to enhance remote customer service capabilities. This initiative reflects a growing trend towards flexible work environments, enabling businesses to maintain high service levels regardless of location. The introduction of these tools may position RingCentral favorably among organizations seeking to adapt to changing workforce dynamics, thereby expanding its market reach.

In August 2025, Genesys (US) unveiled a comprehensive update to its cloud platform, incorporating enhanced machine learning features aimed at optimizing customer interactions. This update is indicative of Genesys's strategy to remain at the forefront of technological innovation, ensuring that its clients can deliver personalized experiences. Such advancements are crucial in a landscape where customer expectations are continually evolving, and companies must adapt swiftly to maintain relevance.

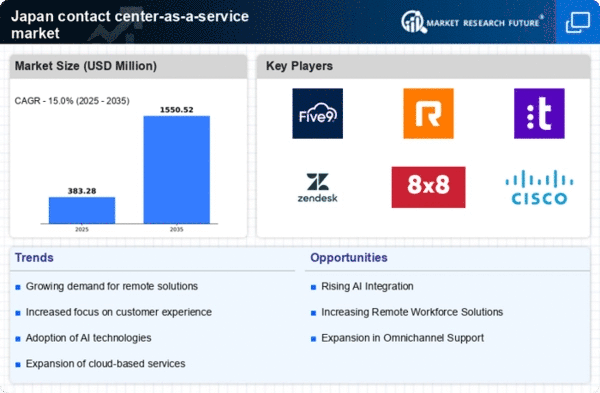

As of November 2025, the most pressing trends in the contact center-as-a-service market include the integration of AI technologies, a heightened focus on sustainability, and the ongoing digital transformation of customer service operations. Strategic alliances are increasingly shaping the competitive landscape, as companies collaborate to enhance their technological capabilities and service offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technology integration, and supply chain reliability. This shift suggests that companies prioritizing these aspects will be better positioned to thrive in an increasingly complex market.