Rising Security Concerns

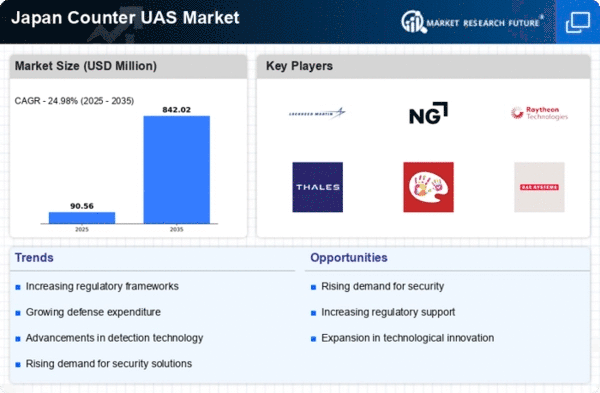

The counter uas market in Japan is experiencing growth driven by escalating security concerns across various sectors. With the increasing prevalence of drones, there is a heightened awareness of potential threats posed by unauthorized uas operations. This has led to a surge in demand for counter uas solutions, particularly in critical infrastructure, public safety, and defense sectors. According to recent estimates, the market is projected to grow at a CAGR of approximately 15% over the next five years. As organizations seek to protect sensitive areas from drone intrusions, investments in counter uas technologies are likely to increase, thereby bolstering the counter uas market.

Growing Commercial Applications

The counter uas market in Japan is also being propelled by the expanding commercial applications of uas. Industries such as agriculture, logistics, and construction are increasingly utilizing drones for various operations. However, this growth has raised concerns regarding safety and privacy, prompting businesses to seek counter uas solutions to mitigate risks. The market for counter uas technologies is expected to expand as companies invest in protective measures to ensure compliance with regulations and safeguard their operations. This trend indicates a potential market growth of approximately 20% in the commercial sector, further enhancing the counter uas market.

Increased Investment in Defense

Japan's defense budget has seen a notable increase, which is positively impacting the counter uas market. The government has recognized the necessity of addressing emerging threats from uas, leading to substantial investments in defense technologies. This trend is expected to continue, with defense spending projected to rise by 2.5% annually over the next few years. Such financial commitments are likely to facilitate the development and procurement of advanced counter uas systems, thereby strengthening the counter uas market. The focus on national security and defense readiness is driving demand for effective countermeasures against potential drone threats.

Regulatory Framework Enhancements

The evolving regulatory landscape in Japan is shaping the counter uas market. The government is actively working to establish comprehensive regulations governing uas operations, which include safety standards and operational guidelines. These regulations are aimed at minimizing risks associated with drone usage, thereby fostering a safer environment for both commercial and private uas operations. As compliance becomes mandatory, the demand for counter uas solutions is likely to increase, as organizations seek to adhere to new regulations. This regulatory push is expected to contribute to a robust growth trajectory for the counter uas market in the coming years.

Advancements in Detection Technologies

Technological innovations in detection systems are significantly influencing the counter uas market in Japan. Enhanced radar, radio frequency, and optical sensors are being developed to improve the identification and tracking of uas. These advancements enable more effective responses to potential threats, thereby increasing the operational efficiency of counter uas systems. The integration of artificial intelligence and machine learning into these technologies is also expected to enhance their capabilities. As a result, the counter uas market is likely to witness a shift towards more sophisticated solutions, with a projected market value reaching $500 million by 2026.