Government Support and Policy Initiatives

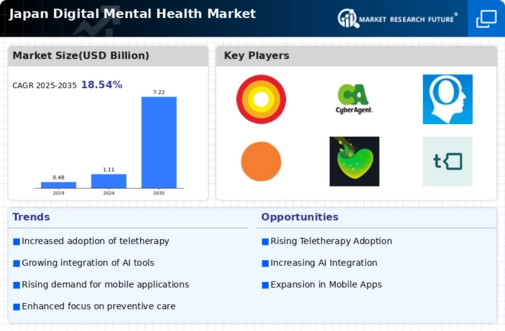

The Japanese government has been actively promoting mental health initiatives, which significantly impacts the digital mental-health market. Recent policy changes aim to enhance access to mental health services, including the integration of digital solutions. For instance, the government has allocated approximately ¥10 billion to support mental health programs, which includes funding for digital platforms. This financial backing is expected to foster innovation and expansion within the digital mental-health market. As a result, more companies are likely to develop and offer digital solutions, thereby increasing accessibility and affordability for users across Japan.

Growing Awareness of Mental Health Issues

In Japan, there is a notable increase in awareness surrounding mental health issues, which is driving the digital mental-health market. Public campaigns and educational initiatives have contributed to a cultural shift, encouraging individuals to seek help for mental health concerns. This heightened awareness is reflected in a survey indicating that approximately 30% of the population acknowledges experiencing mental health challenges. Consequently, the demand for digital mental-health solutions, such as online therapy and mental wellness apps, is on the rise. The digital mental-health market is thus positioned to benefit from this growing recognition, as more individuals are likely to utilize digital platforms for support and resources.

Rising Mental Health Challenges Among Youth

Japan is currently witnessing a concerning rise in mental health challenges among its youth population, which is significantly influencing the digital mental-health market. Reports indicate that approximately 20% of adolescents are experiencing mental health issues, prompting a need for accessible support systems. The digital mental-health market is responding to this urgent demand by developing targeted applications and online resources aimed at young people. These solutions often incorporate gamification and interactive elements to engage users effectively. As awareness of these challenges grows, the market is likely to expand further, providing essential support to a vulnerable demographic.

Technological Advancements in Digital Solutions

Technological advancements are playing a crucial role in shaping the digital mental-health market in Japan. Innovations such as mobile applications, virtual reality, and artificial intelligence are enhancing the effectiveness of mental health interventions. For example, the use of AI-driven chatbots for preliminary assessments and support is gaining traction, with studies suggesting that these tools can improve user engagement by up to 40%. As technology continues to evolve, the digital mental-health market is likely to see an influx of new tools and platforms that cater to diverse mental health needs, making support more accessible to the population.

Increased Demand for Flexible Mental Health Solutions

The demand for flexible mental health solutions is rising in Japan, particularly among younger demographics. Many individuals prefer the convenience of accessing mental health support through digital platforms rather than traditional in-person visits. This trend is evident in a report indicating that over 50% of young adults express a preference for online therapy options. The digital mental-health market is thus responding to this shift by offering a variety of services, including on-demand therapy sessions and self-help resources. This flexibility not only caters to the preferences of users but also helps to reduce the stigma associated with seeking mental health support.