Consumer Awareness and Education

Increasing consumer awareness regarding environmental issues is a pivotal driver for the electric vehicles-battery market in Japan. As more individuals become informed about the benefits of electric vehicles, including lower emissions and reduced operating costs, the demand for electric vehicles is likely to rise. Educational campaigns by both the government and private sector are playing a crucial role in disseminating information about the advantages of electric vehicles and their batteries. Surveys indicate that approximately 70% of consumers are now considering electric vehicles as a viable option for their next purchase. This heightened awareness is expected to translate into increased sales, thereby propelling the electric vehicles-battery market forward. The focus on education suggests that informed consumers are more likely to embrace electric vehicles, fostering a sustainable future.

Environmental Regulations and Standards

Japan's stringent environmental regulations are shaping the electric vehicles-battery market by promoting cleaner technologies. The government has set ambitious targets to reduce greenhouse gas emissions, aiming for a 46% reduction by 2030 compared to 2013 levels. These regulations incentivize manufacturers to invest in electric vehicle technologies and battery production processes that minimize environmental impact. Compliance with these standards often requires significant investment in research and development, which can drive innovation within the electric vehicles-battery market. As a result, companies that adapt to these regulations may gain a competitive edge, potentially leading to increased market share and profitability. This regulatory landscape indicates a strong push towards sustainable practices in the industry.

Investment in Battery Recycling Technologies

The electric vehicles-battery market in Japan is witnessing a growing emphasis on battery recycling technologies. As the number of electric vehicles on the road increases, so does the need for sustainable disposal and recycling of batteries. Companies are investing in innovative recycling processes that can recover valuable materials such as lithium, cobalt, and nickel from used batteries. This not only reduces environmental impact but also addresses supply chain concerns related to raw material shortages. As of November 2025, the recycling rate for lithium-ion batteries in Japan is estimated to reach 50%, reflecting a commitment to sustainability. This trend indicates that the electric vehicles-battery market is evolving towards a circular economy, where resource recovery plays a crucial role in supporting the industry's growth.

Technological Innovations in Battery Production

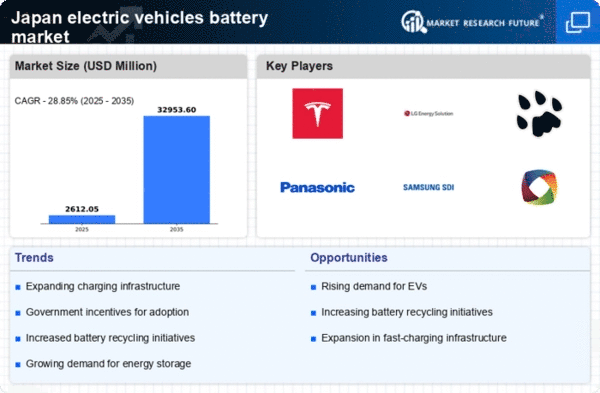

The electric vehicles-battery market in Japan is experiencing a surge in technological innovations that enhance battery production efficiency. Companies are investing heavily in research and development to create batteries with higher energy densities and faster charging capabilities. For instance, advancements in solid-state battery technology are expected to revolutionize the market by offering improved safety and longevity. As of 2025, the market is projected to grow at a CAGR of approximately 15%, driven by these innovations. Furthermore, the integration of artificial intelligence in battery management systems is optimizing performance and lifespan, making electric vehicles more appealing to consumers. This trend indicates a robust future for the electric vehicles-battery market, as manufacturers strive to meet the increasing demands for performance and sustainability.

Infrastructure Development for Charging Stations

The expansion of charging infrastructure is a critical driver for the electric vehicles-battery market in Japan. The government and private sector are collaborating to establish a comprehensive network of charging stations across urban and rural areas. As of November 2025, Japan has over 30,000 public charging points, with plans to increase this number significantly. This infrastructure development not only alleviates range anxiety among consumers but also encourages the adoption of electric vehicles. The availability of fast-charging stations is particularly vital, as it reduces charging time to under 30 minutes for many models. This trend suggests that a well-developed charging network is essential for the growth of the electric vehicles-battery market, as it directly influences consumer purchasing decisions.