Rising Healthcare Expenditure

The increase in healthcare expenditure in Japan is a notable driver of the fertility drug-surgery market. As the population ages and healthcare needs evolve, there is growing investment in reproductive health services. In recent years, healthcare spending in Japan has risen to approximately ¥42 trillion, with a significant portion allocated to reproductive health. This trend indicates a willingness among consumers to invest in fertility treatments, including drugs and surgical options. Moreover, as healthcare providers enhance their offerings and improve service quality, patients are more likely to pursue fertility interventions. The fertility drug-surgery market stands to gain from this upward trajectory in healthcare expenditure, reflecting a broader commitment to addressing fertility challenges and supporting family growth.

Cultural Shifts Towards Family Planning

Cultural shifts in Japan regarding family planning are emerging as significant drivers of the fertility drug-surgery market. Traditionally, societal expectations have influenced family size and childbearing age. However, changing attitudes towards marriage and parenthood are leading many individuals to delay starting families. This trend has led to an increase in age-related fertility issues, prompting greater need for fertility treatments. Reports indicate that the average age of first-time mothers in Japan has risen to 31 years, correlating with a higher incidence of infertility. As a result, the fertility drug-surgery market is likely to see increased demand for both medical and surgical interventions aimed at assisting older couples in achieving their family planning goals. This cultural evolution may continue to shape the market landscape in the coming years.

Increasing Awareness of Fertility Issues

The growing awareness of fertility issues among the Japanese population is a crucial driver of the fertility drug-surgery market. Educational campaigns and media coverage have highlighted the challenges associated with infertility, leading to a surge in individuals seeking assistance. In recent years, approximately 15% of couples in Japan have faced fertility challenges, prompting greater demand for both medical consultations and treatment options. This heightened awareness has led to increased inquiries about fertility drugs and surgical interventions, thereby expanding the market. Furthermore, as societal norms evolve, more individuals are willing to discuss their fertility concerns openly, which may contribute to a more supportive environment for those seeking treatment. Consequently, the fertility drug-surgery market is likely to experience sustained growth as awareness continues to increase.

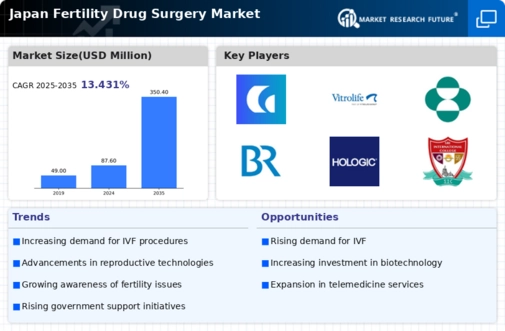

Advancements in Reproductive Technologies

Technological innovations in reproductive medicine significantly influence the fertility drug-surgery market. In Japan, advancements such as in vitro fertilization (IVF) and intracytoplasmic sperm injection (ICSI) have become more refined. These advancements enhance success rates for couples undergoing treatment. The introduction of new fertility drugs designed to improve ovulation and increase the chances of conception has also played a pivotal role. For instance, the market for fertility medications in Japan is projected to reach approximately $1 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 8%. These advancements not only improve treatment outcomes but also attract more patients to seek surgical interventions when necessary. As technology continues to evolve, the fertility drug-surgery market is expected to expand further, driven by the promise of improved reproductive success.

Government Regulations and Support Programs

Government regulations and support programs in Japan play a pivotal role in shaping the fertility drug-surgery market. The Japanese government has implemented various initiatives aimed at addressing the declining birth rate. These initiatives include subsidies for fertility treatments and the establishment of guidelines for assisted reproductive technologies. For instance, the government has allocated approximately ¥100 billion annually to support fertility treatments, making them more accessible to couples. These initiatives not only alleviate the financial burden associated with fertility treatments but also encourage more individuals to seek assistance. As a result, the fertility drug-surgery market is likely to benefit from increased participation in treatment programs, fostering a more favorable environment for growth. The ongoing support from the government may further enhance the market's potential in the years ahead.