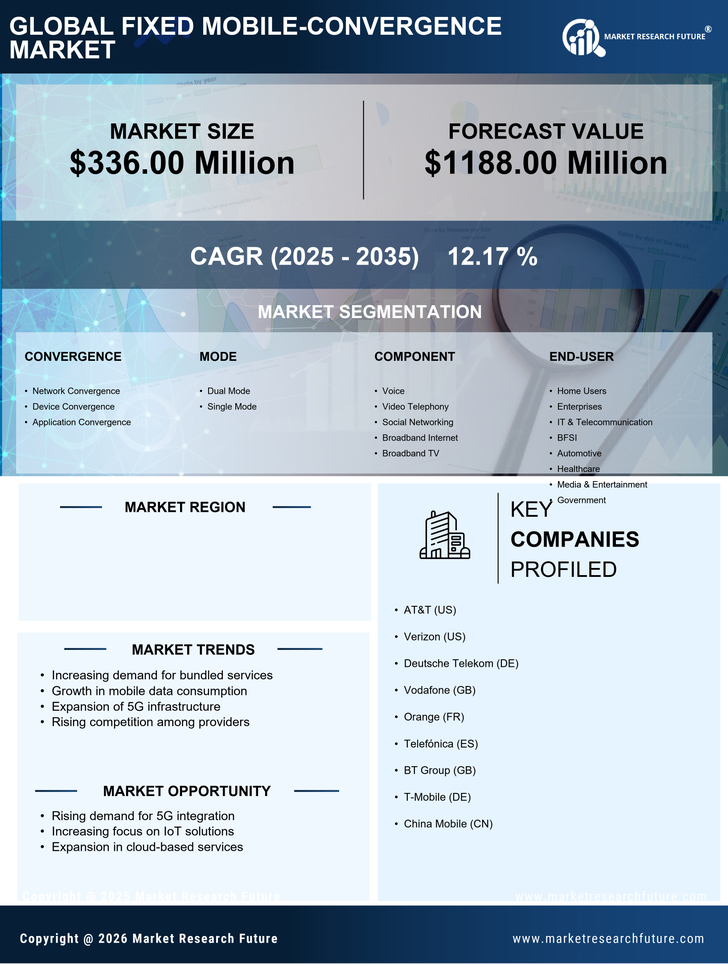

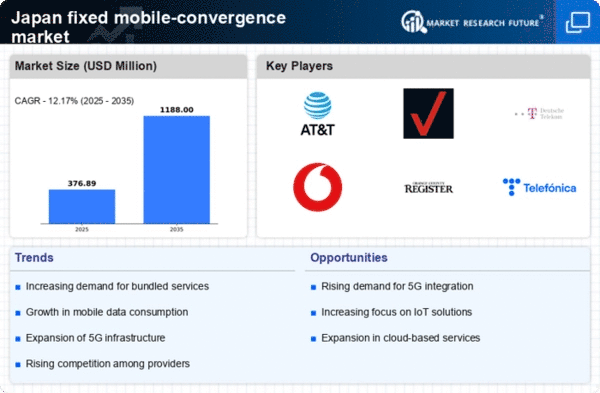

The fixed mobile-convergence market in Japan is characterized by a dynamic competitive landscape, driven by technological advancements and evolving consumer preferences. Major players such as AT&T (US), Deutsche Telekom (DE), and Vodafone (GB) are actively reshaping their strategies to enhance service offerings and improve customer experiences. AT&T (US) focuses on integrating 5G technology with fixed-line services, aiming to provide seamless connectivity. Meanwhile, Deutsche Telekom (DE) emphasizes digital transformation through strategic partnerships, enhancing its service portfolio. Vodafone (GB) is leveraging its extensive network infrastructure to offer bundled services, thereby positioning itself as a comprehensive solutions provider. Collectively, these strategies contribute to a competitive environment that prioritizes innovation and customer-centric solutions.

Key business tactics within this market include localized service offerings and supply chain optimization, which are essential for meeting the diverse needs of Japanese consumers. The competitive structure appears moderately fragmented, with several key players vying for market share. This fragmentation allows for a variety of service options, fostering competition that drives innovation and service quality. The influence of these major companies is significant, as they set benchmarks for service delivery and technological integration.

In October 2025, AT&T (US) announced a partnership with a leading Japanese technology firm to enhance its 5G infrastructure, aiming to improve service reliability and speed. This strategic move is likely to bolster AT&T's competitive position in the market, as it aligns with the growing demand for high-speed connectivity. The partnership may also facilitate the development of new applications and services tailored to local consumer needs, thereby enhancing customer satisfaction.

In September 2025, Deutsche Telekom (DE) launched a new initiative focused on sustainability, committing to reduce its carbon footprint by 50% by 2030. This initiative not only reflects a growing trend towards environmental responsibility but also positions Deutsche Telekom as a leader in sustainable practices within the telecommunications sector. Such a commitment may resonate well with environmentally conscious consumers, potentially increasing brand loyalty and market share.

In August 2025, Vodafone (GB) expanded its service offerings by introducing a new bundled package that combines mobile, broadband, and entertainment services. This strategic action is indicative of a broader trend towards convergence, where consumers seek integrated solutions that simplify their digital lives. By offering comprehensive packages, Vodafone aims to enhance customer retention and attract new subscribers, thereby strengthening its market position.

As of November 2025, current trends in the fixed mobile-convergence market include a pronounced focus on digitalization, sustainability, and the integration of artificial intelligence (AI) into service delivery. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to leverage complementary strengths and enhance their service offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift underscores the importance of agility and responsiveness in meeting the changing demands of consumers.