Increase in Esports Popularity

The rise of esports in Japan is significantly influencing the gaming monitors market. With a growing number of tournaments and professional gaming leagues, there is an increasing demand for high-performance monitors that can support competitive gaming. As of 2025, the esports market in Japan is estimated to reach over $200 million, which is likely to drive sales of specialized gaming monitors. Gamers are increasingly investing in equipment that provides a competitive edge, including monitors with high refresh rates and low response times. This trend suggests that the gaming monitors market will continue to expand as more players seek to enhance their gaming setups to participate in the burgeoning esports scene.

Growing Interest in Home Gaming Setups

The trend of creating dedicated home gaming setups is gaining momentum in Japan, positively impacting the gaming monitors market. As more individuals opt for gaming at home, there is an increasing demand for high-quality monitors that complement these setups. This trend is reflected in the sales of gaming monitors, which have seen a steady increase, with projections indicating a growth rate of around 10% in the coming years. Gamers are investing in larger screens and advanced features to enhance their overall experience. The gaming monitors market is thus likely to thrive as consumers continue to prioritize their home gaming environments, seeking monitors that provide both performance and aesthetic appeal.

Rising Disposable Income Among Consumers

The gaming monitors market in Japan is benefiting from an increase in disposable income among consumers. As economic conditions improve, more individuals are willing to invest in high-quality gaming equipment, including monitors. This trend is particularly evident among younger demographics, who prioritize gaming as a primary form of entertainment. With disposable income levels rising, the market for premium gaming monitors is expected to expand, as consumers seek products that enhance their gaming experiences. The gaming monitors market is likely to see a shift towards higher-priced models that offer advanced features and superior performance, catering to the evolving preferences of the gaming community.

Shift Towards 4K and Ultra-Wide Monitors

In Japan, there is a noticeable shift towards 4K and ultra-wide monitors within the gaming monitors market. As gaming technology evolves, players are seeking higher resolutions and wider aspect ratios for a more immersive experience. The demand for 4K monitors is projected to grow by approximately 15% annually, reflecting gamers' desire for enhanced visual fidelity. Ultra-wide monitors, which provide a broader field of view, are also gaining traction among gamers who appreciate the competitive advantages they offer. This trend indicates that the gaming monitors market is adapting to consumer preferences for advanced display options, which are becoming increasingly popular among both casual and professional gamers.

Technological Advancements in Display Technology

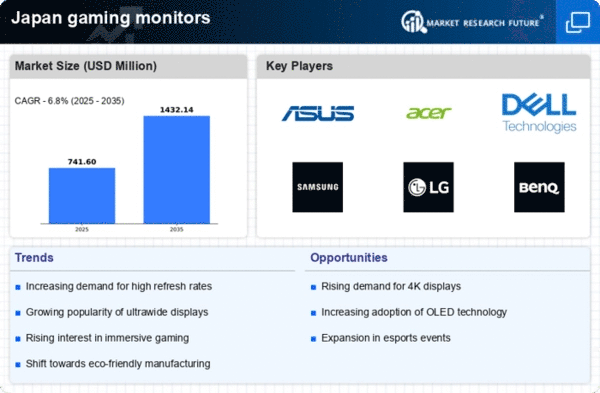

The gaming monitors market in Japan is experiencing a surge due to rapid advancements in display technology. Innovations such as OLED and Mini-LED panels are enhancing visual quality, providing gamers with superior color accuracy and contrast ratios. As of 2025, the market is projected to grow at a CAGR of approximately 8.5%, driven by these technological improvements. Furthermore, the introduction of features like HDR (High Dynamic Range) and variable refresh rates is appealing to consumers seeking immersive gaming experiences. This trend indicates a shift towards high-performance displays, which are becoming essential for competitive gaming. The gaming monitors market is thus likely to benefit from these technological enhancements, as they cater to the increasing demands of gamers for high-quality visuals and performance.