Regulatory Framework Enhancements

The regulatory landscape surrounding the gene expression analysis market in Japan is undergoing enhancements that could positively influence market growth. The Japanese government is actively revising regulations to streamline the approval process for genetic testing and analysis products. These changes aim to facilitate quicker access to innovative gene expression analysis tools for healthcare providers and researchers. In 2025, it is anticipated that the regulatory framework will become more conducive to the introduction of new technologies, thereby fostering competition and innovation within the market. Additionally, the establishment of clear guidelines for the use of gene expression data in clinical settings is likely to enhance trust among stakeholders. As the regulatory environment improves, the gene expression-analysis market is expected to expand, providing greater opportunities for companies to introduce their products and services.

Rising Demand for Precision Medicine

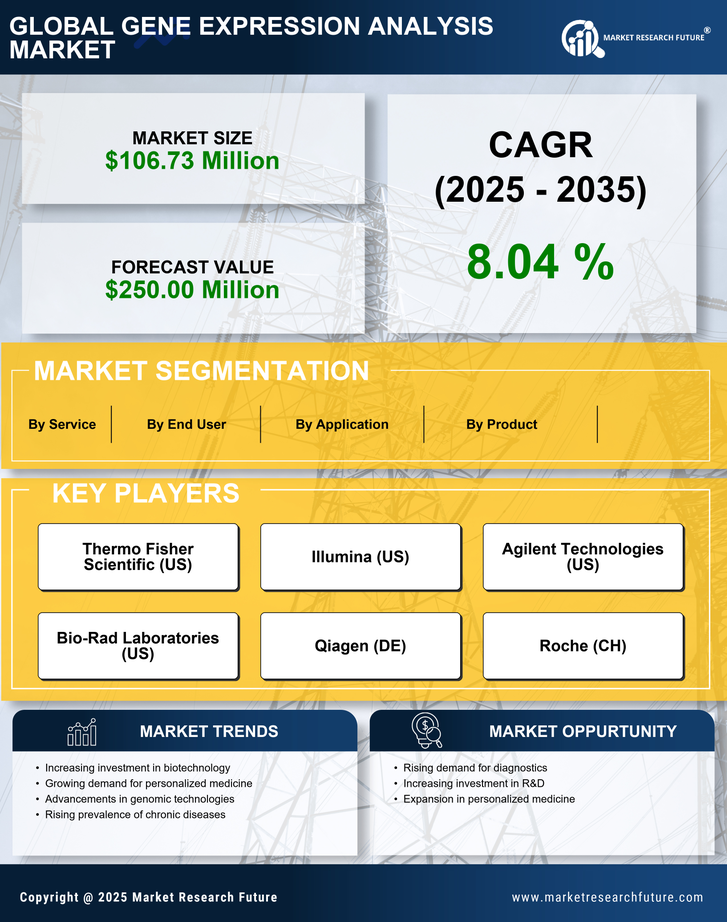

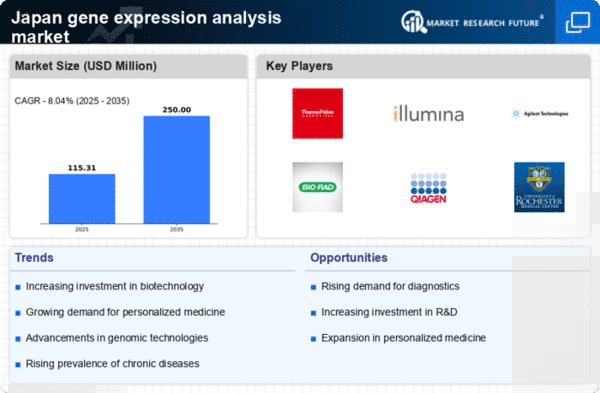

The gene expression analysis market in Japan is experiencing a notable surge in demand driven by the increasing emphasis on precision medicine. As healthcare providers and researchers seek to tailor treatments to individual genetic profiles, the need for advanced gene expression analysis tools becomes paramount. This shift is reflected in the market, which is projected to grow at a CAGR of approximately 8.5% over the next five years. The integration of gene expression data into clinical practice is expected to enhance patient outcomes, thereby propelling the market forward. Furthermore, the Japanese government has been actively promoting initiatives that support the development of personalized therapies, which further stimulates the gene expression-analysis market. This growing focus on individualized treatment strategies indicates a robust future for the market, as stakeholders recognize the potential of gene expression analysis in improving healthcare delivery.

Increased Investment in Biotechnology

Investment in biotechnology is a critical driver for the gene expression-analysis market in Japan. The country has seen a significant influx of funding from both public and private sectors, aimed at advancing biotechnological research and development. In 2025, the Japanese biotechnology sector is expected to receive over $1 billion in investments, which will likely enhance the capabilities of gene expression analysis technologies. This financial support facilitates the development of innovative tools and methodologies, thereby expanding the market. Additionally, collaborations between academic institutions and biotech companies are becoming more prevalent, fostering an environment conducive to breakthroughs in gene expression analysis. As these investments continue to grow, they are expected to catalyze advancements in the gene expression-analysis market, ultimately leading to improved diagnostic and therapeutic options for various diseases.

Growing Awareness of Genetic Disorders

The increasing awareness of genetic disorders among the Japanese population is significantly impacting the gene expression-analysis market. As more individuals become informed about the implications of genetic testing, there is a corresponding rise in demand for gene expression analysis services. This trend is particularly evident in the context of hereditary diseases, where early detection and intervention can lead to better health outcomes. The market is projected to expand as healthcare providers incorporate gene expression analysis into routine diagnostic procedures. Furthermore, educational campaigns and initiatives by health organizations are likely to enhance public understanding of genetic testing, thereby driving market growth. The gene expression-analysis market is expected to benefit from this heightened awareness, as it aligns with the broader trend of proactive healthcare management in Japan.

Advancements in Research and Development

Research and development (R&D) advancements are playing a pivotal role in shaping the gene expression-analysis market in Japan. The country is home to numerous research institutions and universities that are at the forefront of genetic research. In 2025, R&D spending in the life sciences sector is anticipated to reach approximately $3 billion, with a significant portion allocated to gene expression studies. These investments are likely to lead to the development of novel analytical techniques and technologies that enhance the accuracy and efficiency of gene expression analysis. Moreover, collaborations between academia and industry are fostering innovation, resulting in the introduction of cutting-edge products into the market. As R&D continues to thrive, the gene expression-analysis market is expected to evolve, offering new solutions that meet the demands of researchers and clinicians alike.