Potential Economic Benefits

The legal marijuana market in Japan presents substantial economic opportunities that could stimulate growth across various sectors. Estimates suggest that the market could generate revenues exceeding $1 billion annually if fully legalized. This potential economic impact is attracting the attention of policymakers and investors alike. The introduction of a regulated legal marijuana market could lead to job creation in agriculture, retail, and distribution, contributing to local economies. Additionally, tax revenues from cannabis sales could provide funding for public services and infrastructure. As discussions around legalization continue, the prospect of economic benefits may serve as a compelling driver for the legal marijuana market, encouraging stakeholders to advocate for regulatory changes.

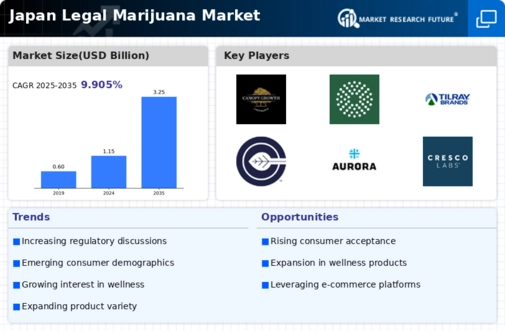

Emerging Consumer Demographics

The legal marijuana market in Japan is witnessing the emergence of new consumer demographics that could reshape the industry landscape. Younger generations, particularly millennials and Gen Z, are showing increased interest in cannabis products, driven by changing cultural attitudes and a desire for alternative wellness solutions. Reports indicate that around 40% of younger consumers are open to trying cannabis, suggesting a shift in market dynamics. This demographic shift may lead to the development of innovative products tailored to the preferences of younger consumers, such as edibles and wellness-focused cannabis items. As these emerging demographics become more influential, they could significantly impact the growth trajectory of the legal marijuana market in Japan.

Advancements in Cannabis Research

The legal marijuana market in Japan is poised for growth due to advancements in cannabis research. Scientific studies are increasingly exploring the therapeutic benefits of cannabinoids, leading to a better understanding of their potential applications in medicine. Research indicates that cannabinoids may offer relief for various conditions, including chronic pain and anxiety disorders. As more evidence emerges, healthcare professionals may become more inclined to recommend cannabis-based treatments, thereby expanding the market. Furthermore, collaborations between universities and private companies are likely to enhance research efforts, fostering innovation within the legal marijuana market. This focus on research could not only improve product quality but also increase consumer confidence in cannabis products.

Influence of International Trends

The legal marijuana market in Japan is influenced by international trends and developments in cannabis legislation. As countries around the world move towards legalization, Japan may feel pressure to reconsider its own policies. Observations from markets in North America and Europe suggest that legalization can lead to economic growth and reduced criminal activity. This international momentum may encourage Japanese policymakers to explore regulatory frameworks that support a legal marijuana market. Additionally, the success of cannabis markets abroad could serve as a model for Japan, providing insights into best practices for regulation and consumer safety. The influence of these international trends may play a crucial role in shaping the future of the legal marijuana market in Japan.

Rising Acceptance of Cannabis Products

The legal marijuana market in Japan is experiencing a notable shift in societal attitudes towards cannabis products. As public perception evolves, there is a growing acceptance of marijuana for both medicinal and recreational use. Surveys indicate that approximately 30% of the population now supports legalization efforts, reflecting a significant change from previous years. This rising acceptance is likely to drive demand within the legal marijuana market, as consumers become more open to exploring cannabis-based products. Furthermore, the potential for economic benefits, such as job creation and tax revenue, may further bolster public support. As acceptance increases, businesses in the legal marijuana market may find new opportunities for growth and innovation, potentially leading to a more robust industry landscape in Japan.