Rising Healthcare Expenditure

The increase in healthcare expenditure in Japan is a significant driver for the occlusion devices market. As the government and private sectors allocate more funds towards healthcare, there is a corresponding rise in the adoption of advanced medical technologies. In recent years, healthcare spending has risen to about 10% of Japan's GDP, reflecting a commitment to improving health outcomes. This financial investment allows hospitals and clinics to procure state-of-the-art occlusion devices, which are essential for effective treatment of various medical conditions. Furthermore, as healthcare budgets expand, there is a greater emphasis on innovative solutions that can enhance patient care. Analysts predict that this trend will contribute to a robust growth trajectory for the occlusion devices market, with an expected increase of 10% annually over the next five years.

Government Initiatives and Funding

Government initiatives and funding aimed at improving healthcare infrastructure are pivotal for the growth of the occlusion devices market. In Japan, the government has been actively promoting the adoption of advanced medical technologies through various funding programs and incentives. These initiatives are designed to enhance the quality of healthcare services and ensure that patients have access to the latest treatment options. For instance, the Ministry of Health, Labour and Welfare has allocated substantial budgets for the development and distribution of innovative medical devices, including occlusion devices. This financial support is expected to stimulate market growth, with projections indicating a potential increase in market size by 15% over the next five years. Such government backing not only encourages manufacturers to innovate but also ensures that healthcare providers can afford to implement these advanced solutions.

Rising Incidence of Cardiovascular Diseases

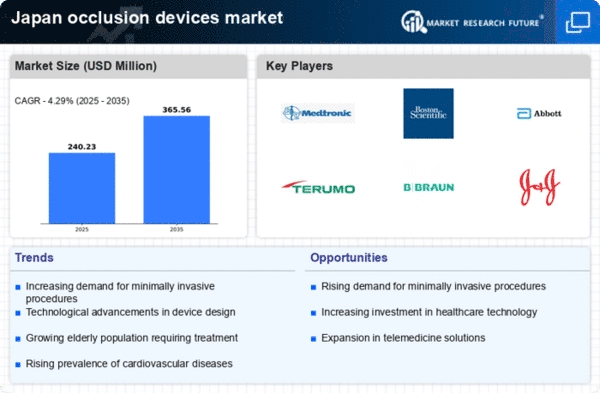

The increasing prevalence of cardiovascular diseases in Japan is a primary driver for the occlusion devices market. As per recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates advanced medical interventions, including occlusion devices, to manage and treat these conditions effectively. The demand for minimally invasive procedures is also on the rise, as patients prefer treatments that offer quicker recovery times. Consequently, healthcare providers are increasingly adopting occlusion devices to address these health challenges. The market is projected to grow at a CAGR of around 8% over the next few years, reflecting the urgent need for innovative solutions in cardiovascular care. This growth is likely to be fueled by advancements in device technology and increased awareness among healthcare professionals regarding the benefits of occlusion devices.

Technological Innovations in Medical Devices

Technological advancements in medical devices are significantly influencing the occlusion devices market. Innovations such as bioresorbable materials and advanced imaging techniques are enhancing the efficacy and safety of occlusion devices. In Japan, the integration of artificial intelligence and robotics in surgical procedures is also gaining traction, leading to improved patient outcomes. The market for occlusion devices is expected to reach approximately $500 million by 2027, driven by these technological innovations. Furthermore, the development of next-generation occlusion devices that offer enhanced precision and reduced complication rates is likely to attract more healthcare providers. As hospitals and clinics invest in state-of-the-art equipment, the demand for advanced occlusion devices is anticipated to rise, thereby propelling market growth. This trend underscores the importance of continuous research and development in the medical device sector.

Increasing Awareness of Minimally Invasive Procedures

The growing awareness of minimally invasive procedures among both healthcare professionals and patients is driving the occlusion devices market. In Japan, there is a notable shift towards procedures that minimize patient discomfort and reduce recovery times. This trend is supported by educational campaigns and training programs that emphasize the benefits of using occlusion devices in various medical applications. As patients become more informed about their treatment options, the demand for minimally invasive solutions is likely to increase. Market analysts estimate that the occlusion devices market could expand by approximately 12% in the coming years, as more healthcare facilities adopt these techniques. This shift not only enhances patient satisfaction but also encourages healthcare providers to invest in advanced occlusion devices, further propelling market growth.