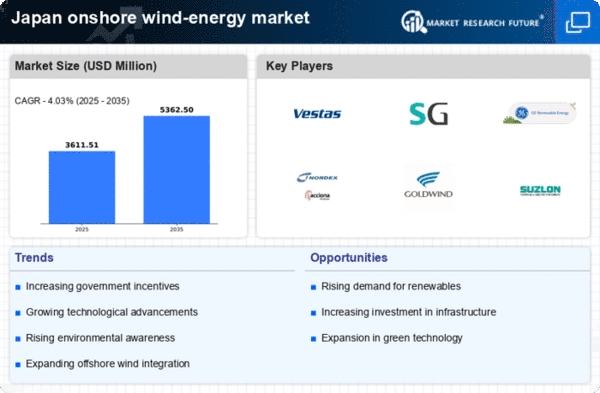

The onshore wind-energy market in Japan is characterized by a dynamic competitive landscape, driven by a combination of technological advancements, regulatory support, and increasing demand for renewable energy. Major players such as Vestas (DK), Siemens Gamesa (ES), and GE Renewable Energy (US) are actively shaping the market through strategic initiatives focused on innovation and regional expansion. Vestas, for instance, emphasizes its commitment to sustainability and efficiency, while Siemens Gamesa leverages its technological prowess to enhance turbine performance. GE Renewable Energy, on the other hand, is concentrating on digital transformation to optimize operations and reduce costs, collectively influencing the competitive environment towards a more sustainable and technologically advanced future. Key business tactics within this market include localizing manufacturing and optimizing supply chains to enhance operational efficiency. The competitive structure appears moderately fragmented, with several key players vying for market share. This fragmentation allows for a diverse range of strategies, as companies adapt to local market conditions and regulatory frameworks. The collective influence of these players fosters a competitive atmosphere where innovation and operational excellence are paramount. In September 2025, Vestas (DK) announced the launch of a new turbine model specifically designed for the Japanese market, which is expected to increase energy output by 15% compared to previous models. This strategic move not only reinforces Vestas' commitment to meeting local energy needs but also positions the company favorably against competitors by enhancing its product offering in a rapidly evolving market. In August 2025, Siemens Gamesa (ES) secured a significant contract to supply wind turbines for a large-scale project in Hokkaido, Japan. This contract is indicative of Siemens Gamesa's strategic focus on expanding its footprint in the Asia-Pacific region, which is anticipated to contribute substantially to its revenue growth. The project is expected to bolster the company's reputation as a leader in the onshore wind sector, particularly in a market that is increasingly prioritizing renewable energy sources. In October 2025, GE Renewable Energy (US) unveiled a partnership with a local Japanese firm to enhance its supply chain capabilities. This collaboration aims to streamline logistics and reduce costs, thereby improving the overall efficiency of wind farm operations. Such partnerships are crucial in a market where local expertise and operational agility can significantly impact project success. As of November 2025, current competitive trends in the onshore wind-energy market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence (AI) into operational processes. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing technological capabilities and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, advanced technology, and supply chain reliability, reflecting the growing importance of sustainable practices in the energy sector.