Rising Awareness of Preventive Healthcare

There is a growing awareness of preventive healthcare among the Japanese population, which is driving the patient temperature-monitoring market. As individuals become more health-conscious, they are increasingly seeking tools to monitor their health proactively. This trend is reflected in the rising sales of home monitoring devices, including thermometers that provide accurate temperature readings. The market is witnessing a shift towards self-monitoring, with consumers valuing the ability to track their health metrics conveniently. This heightened awareness is likely to encourage manufacturers to innovate and improve their product offerings, further stimulating the patient temperature-monitoring market in Japan.

Government Initiatives and Healthcare Policies

Government initiatives in Japan aimed at improving healthcare infrastructure are positively influencing the patient temperature-monitoring market. Policies promoting the adoption of digital health technologies and funding for innovative medical devices are creating a conducive environment for market growth. The Japanese government has allocated substantial budgets to enhance healthcare services, which includes investments in temperature-monitoring technologies. These initiatives are expected to increase accessibility and affordability of monitoring devices, thereby expanding their usage in both clinical and home settings. As a result, the patient temperature-monitoring market is likely to benefit from these supportive policies, fostering innovation and improving patient outcomes.

Aging Population and Chronic Disease Management

Japan's aging population significantly impacts the patient temperature-monitoring market. With a growing number of elderly individuals, there is an increased prevalence of chronic diseases that require regular monitoring. The need for effective temperature management in these patients is paramount, as it can indicate the onset of infections or other complications. According to recent statistics, over 28% of Japan's population is aged 65 and older, creating a substantial demand for reliable monitoring solutions. Healthcare providers are increasingly focusing on preventive care, which necessitates the use of advanced temperature-monitoring devices. This demographic shift suggests that the patient temperature-monitoring market will continue to expand as healthcare systems adapt to meet the needs of this population.

Technological Advancements in Monitoring Devices

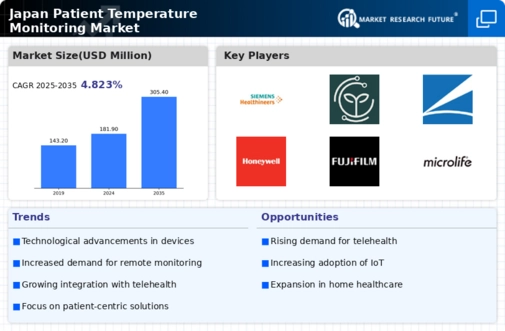

The patient temperature-monitoring market is experiencing a surge due to rapid technological advancements in monitoring devices. Innovations such as smart thermometers and wearable sensors are enhancing the accuracy and efficiency of temperature monitoring. In Japan, the integration of IoT technology into these devices allows for real-time data transmission to healthcare providers, facilitating timely interventions. The market was projected to grow at a CAGR of approximately 8% over the next five years, driven by these advancements. Furthermore, the increasing adoption of mobile health applications complements these devices, enabling patients to track their health metrics conveniently. This trend indicates a shift towards more personalized healthcare solutions, which is likely to further propel the patient temperature-monitoring market in Japan.

Integration of Artificial Intelligence in Monitoring Solutions

The integration of artificial intelligence (AI) in patient temperature-monitoring solutions is a key driver in the market. AI technologies enhance the capabilities of monitoring devices by enabling predictive analytics and personalized health insights. In Japan, healthcare providers are increasingly adopting AI-driven solutions to improve patient care and streamline operations. These technologies can analyze temperature data in conjunction with other health metrics, allowing for more accurate assessments and timely interventions. The potential for AI to transform the patient temperature-monitoring market is substantial, as it not only improves the accuracy of readings but also enhances the overall patient experience.