Government Initiatives and Funding

Government initiatives and funding aimed at enhancing healthcare infrastructure in Japan are pivotal for the growth of the point of-care-molecular-diagnostics market. The Japanese government has been investing in healthcare innovation, with a budget allocation of approximately $10 billion for medical research and development in recent years. This financial support fosters the development of new diagnostic technologies and encourages collaboration between public and private sectors. Additionally, initiatives to improve access to healthcare services in rural areas further drive the demand for point-of-care diagnostics. As a result, the point of-care-molecular-diagnostics market is likely to experience accelerated growth, bolstered by these supportive government measures.

Rising Demand for Rapid Diagnostics

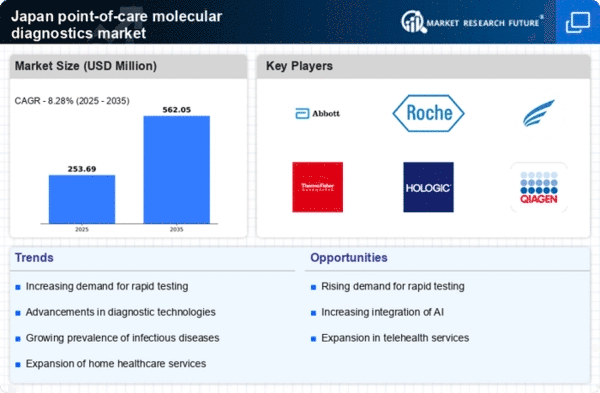

The increasing need for rapid diagnostic solutions in Japan is a key driver for the point of-care-molecular-diagnostics market. Healthcare providers are under pressure to deliver timely results, particularly in emergency and outpatient settings. This demand is reflected in the market, which is projected to grow at a CAGR of approximately 10% over the next five years. The ability to obtain results within minutes rather than days enhances patient management and treatment outcomes. Furthermore, the aging population in Japan, which is expected to reach 36% by 2040, necessitates efficient diagnostic tools to manage chronic diseases effectively. As a result, the point of-care-molecular-diagnostics market is likely to expand significantly to meet these urgent healthcare needs.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning into diagnostic devices is transforming the point of-care-molecular-diagnostics market. These technologies enhance the accuracy and efficiency of diagnostic tests, allowing for better patient outcomes. In Japan, the adoption of AI-driven diagnostics is gaining traction, with a projected market value of $1 billion by 2027. This technological evolution not only streamlines workflows but also reduces the potential for human error, which is crucial in clinical settings. As healthcare providers increasingly seek innovative solutions to improve diagnostic capabilities, the point of-care-molecular-diagnostics market is poised for substantial growth, driven by these technological advancements.

Growing Awareness of Infectious Diseases

The rising awareness of infectious diseases in Japan is a significant driver for the point of-care-molecular-diagnostics market. Public health campaigns and educational initiatives have heightened the understanding of disease prevention and early detection among the population. This awareness is reflected in the increasing demand for rapid testing solutions, particularly for conditions such as influenza and sexually transmitted infections. The market for infectious disease diagnostics is projected to grow by 8% annually, indicating a robust interest in point-of-care solutions. As healthcare providers respond to this demand, the point of-care-molecular-diagnostics market is expected to expand, providing essential tools for timely diagnosis and treatment.

Increased Focus on Personalized Medicine

The shift towards personalized medicine in Japan is significantly influencing the point of-care-molecular-diagnostics market. As healthcare moves away from a one-size-fits-all approach, there is a growing emphasis on tailored treatments based on individual genetic profiles. This trend is supported by advancements in molecular diagnostics, which enable healthcare providers to identify specific biomarkers associated with various diseases. The market for personalized medicine is expected to reach $5 billion by 2026 in Japan, indicating a robust demand for molecular diagnostic tools that facilitate this approach. Consequently, the point of-care-molecular-diagnostics market is likely to benefit from this trend, as it aligns with the need for precise and individualized healthcare solutions.