Supportive Regulatory Environment

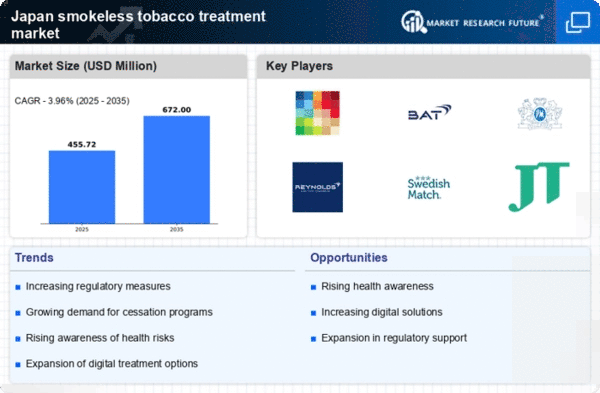

The regulatory environment in Japan is becoming increasingly supportive of initiatives aimed at reducing tobacco use, which is beneficial for the smokeless tobacco-treatment market. Recent regulations have focused on stricter advertising laws and increased taxation on tobacco products, which may discourage usage. In 2025, it was reported that the government plans to implement additional measures to further restrict tobacco sales, potentially leading to a decrease in smokeless tobacco consumption. This regulatory framework is likely to create a more favorable landscape for treatment options, as more individuals may seek assistance to quit.

Increasing Public Health Campaigns

The smokeless tobacco-treatment market in Japan is experiencing growth due to increasing public health campaigns aimed at reducing tobacco use. Government initiatives and non-profit organizations are actively promoting awareness about the health risks associated with smokeless tobacco. These campaigns often highlight the dangers of oral cancers and other health issues, which may lead to a decline in usage. As a result, more individuals are seeking treatment options, thereby expanding the smokeless tobacco-treatment market. In 2023, it was reported that approximately 30% of the population was aware of the risks, indicating a potential for further growth as awareness increases. This trend suggests that sustained public health efforts could significantly impact the market dynamics in the coming years.

Technological Advancements in Treatment

Technological advancements are playing a crucial role in shaping the smokeless tobacco-treatment market in Japan. Innovations such as digital health applications and telemedicine are making it easier for individuals to access treatment and support. These technologies provide personalized treatment plans and real-time monitoring, which may enhance the effectiveness of cessation programs. In 2024, it was estimated that the adoption of digital health solutions in tobacco cessation increased by 25%, indicating a shift towards more tech-driven approaches. This trend suggests that as technology continues to evolve, it could lead to more effective treatment options, thereby expanding the smokeless tobacco-treatment market.

Growing Demand for Alternative Therapies

There is a growing demand for alternative therapies within the smokeless tobacco-treatment market in Japan. As individuals become more aware of the limitations of traditional cessation methods, they are increasingly exploring holistic and alternative approaches. This includes therapies such as acupuncture, herbal remedies, and mindfulness practices, which are perceived as less invasive and more aligned with personal health philosophies. In 2023, it was estimated that alternative therapies accounted for approximately 15% of the treatment market, indicating a notable trend. This shift suggests that the smokeless tobacco-treatment market may need to adapt to incorporate these alternative options to meet evolving consumer preferences.

Cultural Shifts Towards Healthier Lifestyles

Cultural shifts in Japan towards healthier lifestyles are influencing the smokeless tobacco-treatment market. As societal norms evolve, there is a growing emphasis on wellness and preventive health measures. This shift is reflected in the increasing number of individuals seeking to quit smokeless tobacco, driven by a desire for improved health and well-being. In recent surveys, approximately 40% of respondents indicated a commitment to reducing tobacco use as part of their lifestyle changes. This cultural transformation may lead to a sustained increase in demand for treatment options, thereby positively impacting the smokeless tobacco-treatment market.