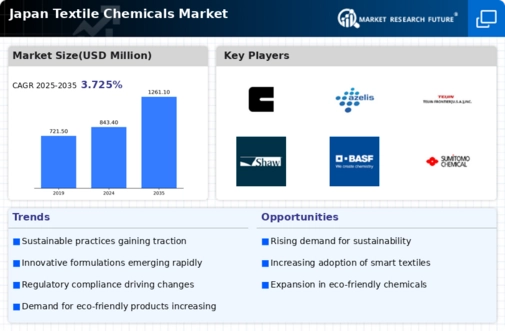

The Textile Chemicals Market in Japan is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as

BASF (DE), Huntsman Corporation (US), and Clariant (CH) are actively pursuing strategies that emphasize product development and regional expansion. For instance, BASF (DE) has focused on enhancing its portfolio of sustainable textile chemicals, which aligns with the growing demand for eco-friendly solutions. Huntsman Corporation (US) appears to be leveraging its expertise in specialty chemicals to cater to niche markets, while Clariant (CH) is investing in digital transformation initiatives to optimize its operations and improve customer engagement. Collectively, these strategies indicate a shift towards a more integrated and responsive market environment.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and enhance supply chain efficiency. The market structure is moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This competitive dynamic fosters innovation and drives companies to differentiate their offerings, particularly in sustainability and performance.

In October 2025, Huntsman Corporation (US) announced a strategic partnership with a leading Japanese textile manufacturer to develop advanced dyeing technologies that minimize water usage. This collaboration is significant as it not only addresses environmental concerns but also positions Huntsman as a leader in sustainable textile solutions. The partnership is likely to enhance Huntsman's market presence in Japan, aligning with the increasing regulatory focus on sustainability in the textile sector.

In September 2025,

Clariant (CH) launched a new line of biodegradable textile chemicals aimed at reducing environmental impact. This initiative reflects Clariant's commitment to sustainability and innovation, potentially attracting environmentally conscious consumers and manufacturers. The introduction of these products may strengthen Clariant's competitive edge in a market that is progressively prioritizing eco-friendly solutions.

In August 2025, BASF (DE) expanded its production capacity for textile chemicals in Japan, signaling a robust commitment to meeting local demand. This expansion is likely to enhance BASF's operational efficiency and responsiveness to market needs, reinforcing its position as a key player in the region. The move may also indicate a broader trend of companies investing in local capabilities to better serve their customers.

As of November 2025, the competitive trends in the textile chemicals market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and addressing complex market challenges. Looking ahead, competitive differentiation is expected to evolve, with a notable shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition underscores the importance of adapting to changing consumer preferences and regulatory landscapes, positioning companies for sustained success in a dynamic market.