Research Methodology on Textile Chemicals Market

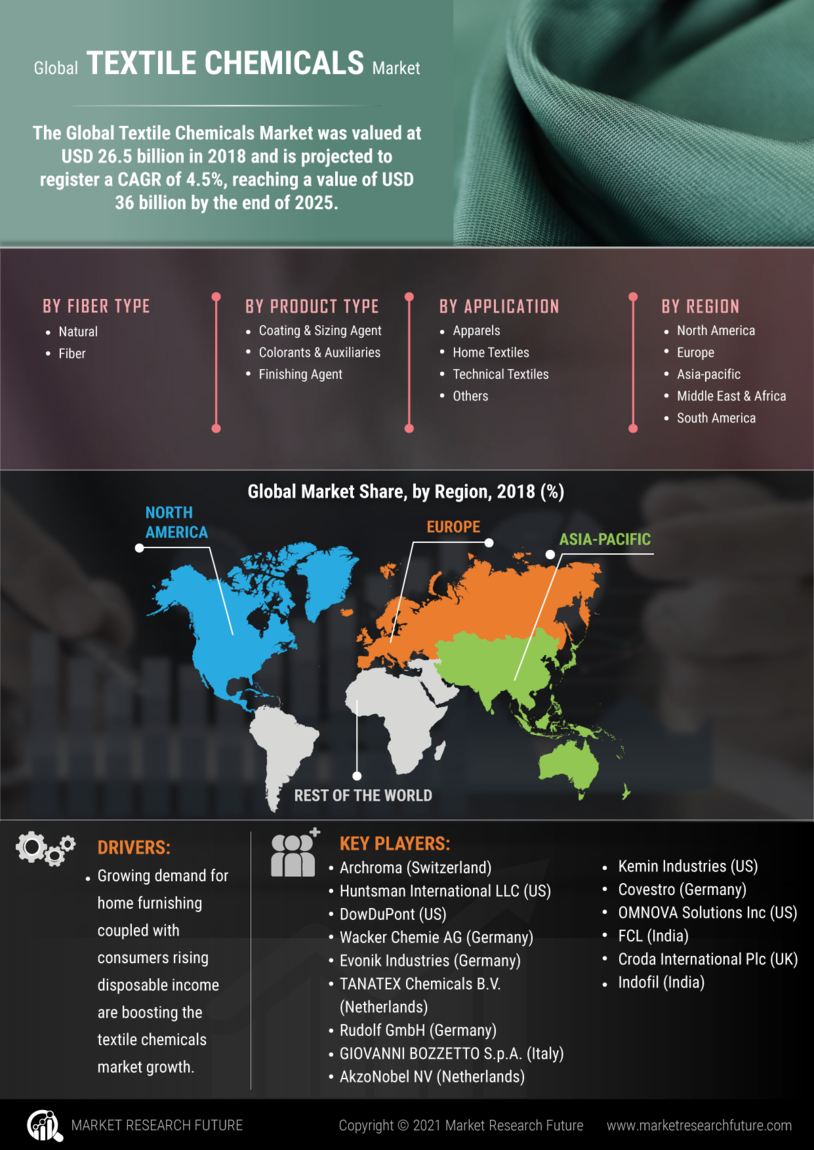

The Textile Chemicals Market research report is a detailed investigation of the global market, which provides market insights such as market size, growth rate, regional analysis, competitive landscape, and major product segments. This report has adopted a comprehensive research strategy to understand the global market for Textile Chemicals. Primary and secondary data research techniques are used for an accurate and comprehensive understanding of the market.

Research Objectives

The primary objective of this research report is to investigate the structural outline of the global market for Textile Chemicals, forecast the market by providing realistic estimations for the key market segments, and provide an in-depth understanding of the market size, shares, trends, and opportunities. The secondary objective is to provide insights into the driving, restraining, and major challenges faced by the market.

Research Design

To better understand the changing dynamics of the global market for Textile Chemicals, a total of 5 research designs have been adopted. They include PESTEL analysis, Porter's Five Forces Model, SWOT analysis, market size estimation, and market segmentation. The research designs were used to determine the driving forces and constraints of the market, understand market opportunities, and help with estimating the size of the market.

Primary Research

The primary research is based on interviews conducted with key industry stakeholders and experts, including manufacturers and suppliers of Textile Chemicals. The stakeholders were asked questions about their current and future products, market trends, and growth drivers and challenges.

Secondary Research

The secondary research technique employed in this report includes studies from industry experts, published data from statistical bodies, annual reports from market participants, a range of industry databases, and other industry sources. This data is used to verify the primary research findings and gain a better understanding of the market.

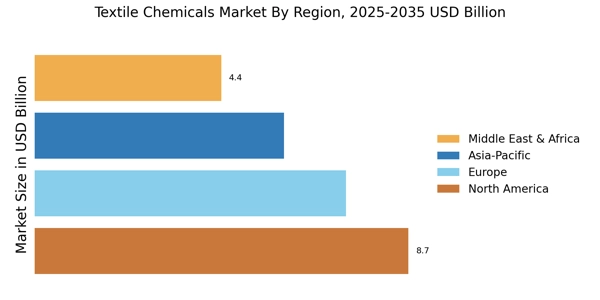

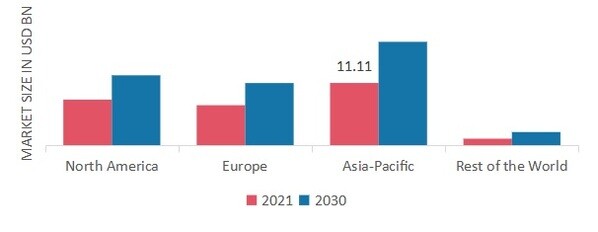

Market Size Estimation

The global market size for Textile Chemicals is estimated by taking into account the market share of the leading players and the region-wise market share. The estimation of the market size of global Textile Chemicals is done by using the triangulation method, which is based on the bottom-up approach.

Data Triangulation

The data triangulation method is used to estimate and validate the global market size of Textile Chemicals by combining the different pliable sources. This method includes secondary research, primary research, and expert panel validation.

Market Breakdown

The market was segmented based on product type, end-use industry, and region. The market size and estimated revenue generated by each segment are taken into account in order to predict future market trends.

Assumptions

The assumptions for this research report included the data of the manufacturers, suppliers, and distributors of Textile Chemicals. It was assumed that the market is organized, and the participants are informed of both the advantages and disadvantages of the market. It was also assumed that the market operates in a stable economic environment and that there have been no drastic changes in the regulatory environment in the past few years.

Conclusion

The research report presented a comprehensive overview of the global market for Textile Chemicals. Primary and secondary research techniques have been used to gain a better understanding of the market and the applicable trends. Market size estimation and market segmentation were used to estimate the size of the market, while assumptions were provided in order to confirm the trends.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review