Rising Consumer Awareness

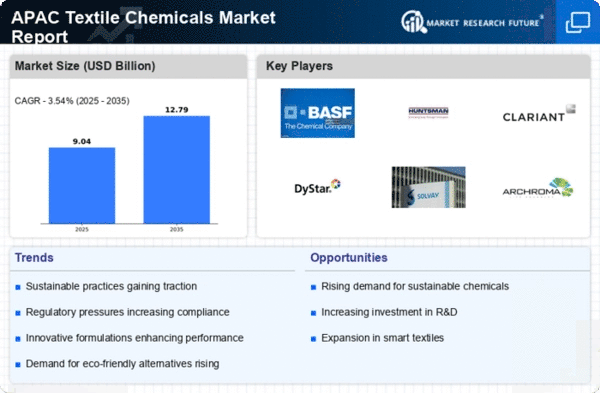

The textile chemicals market in APAC is experiencing a notable shift due to increasing consumer awareness regarding the environmental impact of textile production. As consumers become more informed about the harmful effects of certain chemicals, there is a growing demand for eco-friendly alternatives. This trend is reflected in the market, where the demand for sustainable textile chemicals is projected to grow at a CAGR of 8% from 2025 to 2030. Companies are responding by investing in research and development to create safer, biodegradable chemicals. This heightened awareness not only influences purchasing decisions but also compels manufacturers to adopt greener practices, thereby reshaping the textile chemicals market.

Growth of the Fashion Industry

The textile chemicals market in APAC is closely linked to the rapid growth of the fashion industry. As the demand for diverse and innovative fabrics increases, so does the need for specialized textile chemicals. The fashion sector is projected to expand at a CAGR of 7% over the next five years, which will likely drive the demand for various chemical treatments, including dyes, finishes, and coatings. This growth presents opportunities for chemical manufacturers to develop new products tailored to the evolving needs of fashion brands. Consequently, the textile chemicals market is poised for substantial growth, driven by the dynamic nature of fashion trends.

Increasing Export Opportunities

The textile chemicals market in APAC is benefiting from increasing export opportunities as countries in the region enhance their manufacturing capabilities. With a growing emphasis on quality and compliance with international standards, APAC countries are becoming key players in the global textile supply chain. The export of textile chemicals is projected to rise by 10% over the next few years, driven by demand from markets in Europe and North America. This trend not only boosts the local economy but also encourages investment in the textile chemicals market, fostering innovation and competitiveness among manufacturers.

Government Regulations and Policies

In APAC, stringent government regulations regarding chemical usage in textiles are significantly impacting the textile chemicals market. Governments are implementing policies aimed at reducing pollution and promoting sustainable practices. For instance, regulations on hazardous substances are becoming more rigorous, pushing manufacturers to comply with safety standards. This regulatory environment is expected to drive innovation in the development of safer chemical alternatives. The market is likely to see an increase in compliance costs, but this could also lead to a more sustainable industry in the long run. The anticipated growth in the market is estimated at 6% annually as companies adapt to these regulations.

Technological Innovations in Production

Technological advancements in production processes are transforming the textile chemicals market in APAC. Innovations such as digital printing and nanotechnology are enabling manufacturers to create high-performance textiles with enhanced properties. These technologies not only improve efficiency but also reduce waste and energy consumption. The integration of smart textiles, which incorporate chemical treatments for functionalities like moisture management and UV protection, is gaining traction. As a result, the market is expected to grow by approximately 5% annually, driven by the demand for innovative solutions that meet consumer expectations for quality and sustainability.